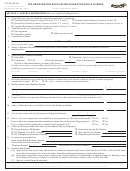

Form Tr1 - Tax Registration Page 2

ADVERTISEMENT

Part A continued

General Details

10. Partnership, Trust or Other Body

Give the following information in respect of all partners, trustees or other officers. Under ‘Capacity’, state whether

precedent acting partner, partner, trustee, treasurer, etc. If necessary continue on a separate sheet.

Name

Private Address

Capacity

PPS number (Partners only)

A3

Business Details

11. If trading under a business name, state

Trading as

12. Legal Format (tick þ appropriate box)

Sole Trade

Partnership

Other

13. Business Address (if different to private address)

Phone: Number

(

)

Fax: Number

(

)

Mobile Phone Number

E-Mail

14. Type of business

(a) Is the business

mainly retail

mainly wholesale

mainly manufacturing

building & construction

forestry/meat processing

service and other

(b) Describe the business conducted in as much detail as possible. Give a precise description such as ‘newsagent’,

‘clothing manufacturer’, ‘property letting’, ‘dairy farmer’, ‘investment income’, etc. Do not use general terms such as

‘shopkeeper’, ‘manufacturer’, ‘computers’, ‘consultant’, etc.

If the application is a property related activity you may also need to complete Panel 30.

15. If the business will supply plastic bags to the customer tick þ box

16. When did the business or activity commence?

/

/

17. To what date will annual accounts be made up?

/

/

18. State the expected turnover in the next twelve months

£

19. Adviser Details

Give the following details of your accountant or tax adviser, if any,

who will prepare the accounts and tax returns of the business.

Name

Phone: Number

(

)

Address

Fax: Number

(

)

Mobile Phone Number

Tax Adviser Identification Number

Client’s Reference

(TAIN)

20. If correspondence relating to VAT (i.e. VAT 3s) is being dealt with by the accountant or tax adviser tick þ box

21. If you rent your business premises, state

Name and private address of the landlord

(not an estate agent or rent collector)

(tick þ frequency)

£

The amount of rent paid per week

, month

or year

The date on which you started paying the rent

/

/

The length of the agreed rental/lease period.

22. If you acquired the business from a previous owner, state

The name and current address of the person

from whom you acquired it

The VAT/registered number of that person

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4