Form Tr1 - Tax Registration Page 4

ADVERTISEMENT

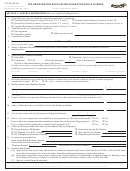

Part D

Registration as an Employer for PAYE / PRSI

32. If you are registering as an employer for PAYE/PRSI tick þ box and complete this part

33. Persons Engaged

(a) How many employees are:

Full time - usually working 30 hours or more per week?

Part time - usually working less than 30 hours per week?

(b) State the date your first employee commenced or will commence in your employment

/

/

34. What payroll and PAYE/PRSI record system will you use? (tick þ the relevant box)

(a) Computer System

Please register for the Revenue On-Line Service (ROS) at

to receive electronic copies of Tax Credit Certificates

(b) Other Manual System

Wages books are available from Office Suppliers/Stationery Bookstores

35. Correspondence on PAYE/PRSI

If correspondence relating to PAYE/PRSI is being dealt with by an agent, tick þ this box

and give the following

details if different from 19 above.

Name

Phone: Number

(

)

Address

Fax: Number

(

)

Mobile Phone Number

Tax Adviser Identification Number

Client’s Reference

(TAIN)

(Relevant Contracts Tax)

Part E

Registration as a Principal Contractor

36. If you are registering as a Principal Contractor for RCT in the Construction/

Forestry/Meat Processing industries, tick þ box and complete this part

/

/

37. Date of Commencement as a Principal

38. Number of uncertified Subcontractors currently engaged

39. Confirm that Form RCT1 has been completed for all Subcontractors (tick þ)

Yes

No

40. State Addresses of all sites on which uncertified Subcontractors are currently engaged

(A further sheet should be attached if required)

41. I wish to apply for the following number of RCTDC’s/C45’s and, in so doing, I confirm that the RCTDC’s/C45’s

will be used exclusively in the course of the Principal Contractor’s business

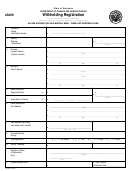

Additional Information

The following leaflets will provide additional information on the taxation aspects of running your own business. They are

available at

, from Revenue’s Form’s and Leaflets service at LoCall 1890 306 706 (available 24 hours a

day) or from your local Revenue office.

IT48

Starting in Business – A Revenue Guide

IT49

VAT for Small Businesses

IT50

PAYE/PRSI for Small Employers

IT63

Relevant Contracts Tax - Guide for Principal Contractors

If you have further information queries or concerns contact your local Revenue office or Employer PAYE Enquiries at

LoCall 1890 25 45 65.

If you want information on payment options, including Direct Debit, contact the Collector-General at LoCall 1890 20 30 70.

Revenue On-Line Service (ROS) Save time – File On-Line

Once registered, you can access your tax details and file returns on-line using Revenue On-Line Service (ROS).

ROS is available 24 hours a day, 365 days a year. It is easy, instant and secure.

For further details on ROS, visit our website at

or call the ROS Information Desk at LoCall 1890 20 11 06.

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4