It-360.1 - Change Of City Resident Status

ADVERTISEMENT

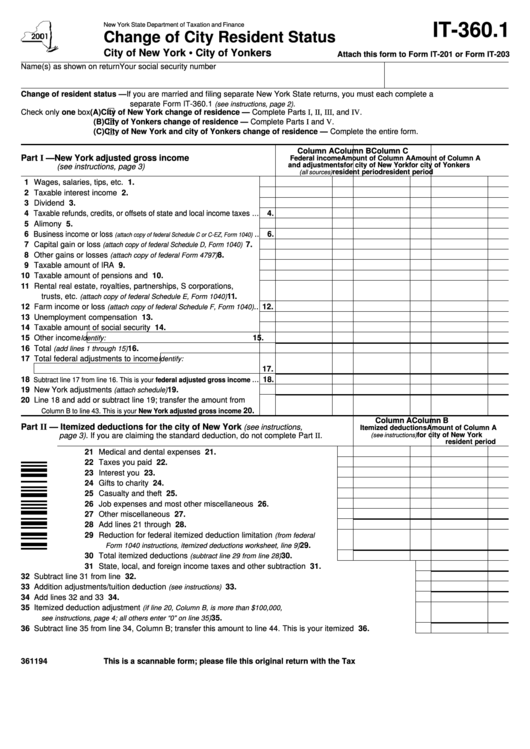

New York State Department of Taxation and Finance

IT-360.1

Change of City Resident Status

•

City of New York

City of Yonkers

Attach this form to Form IT-201 or Form IT-203

Name(s) as shown on return

Your social security number

Change of resident status — If you are married and filing separate New York State returns, you must each complete a

separate Form IT-360.1

.

(see instructions, page 2)

Check only one box (A)

City of New York change of residence — Complete Parts I, II, III, and IV.

(B)

City of Yonkers change of residence — Complete Parts I and V.

(C)

City of New York and city of Yonkers change of residence — Complete the entire form.

Column A

Column B

Column C

Part I — New York adjusted gross income

Federal income

Amount of Column A Amount of Column A

and adjustments

for city of New York

for city of Yonkers

(see instructions, page 3)

resident period

resident period

(all sources)

1 Wages, salaries, tips, etc. .............................................................. 1.

2 Taxable interest income ................................................................. 2.

3 Dividend income ............................................................................

3.

4 Taxable refunds, credits, or offsets of state and local income taxes ...

4.

5 Alimony received ............................................................................

5.

6 Business income or loss

.. 6.

(attach copy of federal Schedule C or C-EZ, Form 1040)

7 Capital gain or loss

...... 7.

(attach copy of federal Schedule D, Form 1040)

8 Other gains or losses

.................. 8.

(attach copy of federal Form 4797)

9 Taxable amount of IRA distributions .............................................. 9.

10 Taxable amount of pensions and annuities ................................... 10.

11 Rental real estate, royalties, partnerships, S corporations,

trusts, etc.

............. 11.

(attach copy of federal Schedule E, Form 1040)

12 Farm income or loss

.. 12.

(attach copy of federal Schedule F, Form 1040)

13 Unemployment compensation ....................................................... 13.

14 Taxable amount of social security benefits .................................... 14.

15 Other income

15.

Identify:

16 Total

............................................................ 16.

(add lines 1 through 15)

17 Total federal adjustments to income

Identify:

17.

18

... 18.

Subtract line 17 from line 16. This is your federal adjusted gross income

19 New York adjustments

......................................... 19.

(attach schedule)

20 Line 18 and add or subtract line 19; transfer the amount from

....... 20.

Column B to line 43. This is your New York adjusted gross income

Column A

Column B

Part II — Itemized deductions for the city of New York

(see instructions,

Itemized deductions

Amount of Column A

for city of New York

page 3). If you are claiming the standard deduction, do not complete Part II.

(see instructions)

resident period

21 Medical and dental expenses .............................................................. 21.

22 Taxes you paid ..................................................................................... 22.

23 Interest you paid .................................................................................. 23.

24 Gifts to charity ...................................................................................... 24.

25 Casualty and theft losses ..................................................................... 25.

26 Job expenses and most other miscellaneous deductions ................... 26.

27 Other miscellaneous deductions .......................................................... 27.

28 Add lines 21 through 27 ....................................................................... 28.

29 Reduction for federal itemized deduction limitation

(from federal

................ 29.

Form 1040 instructions, itemized deductions worksheet, line 9)

30 Total itemized deductions

......................... 30.

(subtract line 29 from line 28)

31 State, local, and foreign income taxes and other subtraction adjustments ............................. 31.

32 Subtract line 31 from line 30 .................................................................................................................................. 32.

33 Addition adjustments/tuition deduction

33.

(see instructions) .....................................................................................................

34 Add lines 32 and 33 ............................................................................................................................................... 34.

35 Itemized deduction adjustment

(if line 20, Column B, is more than $100,000,

............................................................................................. 35.

see instructions, page 4; all others enter “0” on line 35)

36 Subtract line 35 from line 34, Column B; transfer this amount to line 44. This is your itemized deduction ........... 36.

361194

This is a scannable form; please file this original return with the Tax Department.

IT-360.1 2001

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2