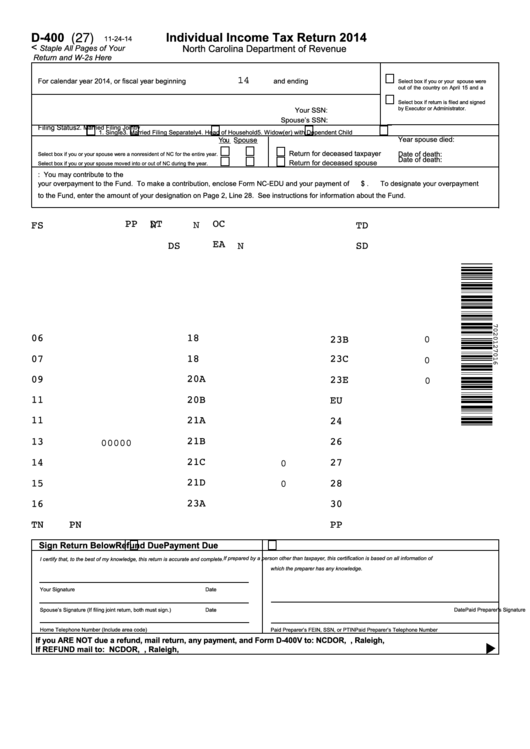

D-400

Individual Income Tax Return 2014

(27)

11-24-14

<

North Carolina Department of Revenue

Staple All Pages of Your

Return and W-2s Here

14

For calendar year 2014, or fiscal year beginning

and ending

Select box if you or your spouse were

out of the country on April 15 and a

U.S. citizen or resident.

Select box if return is filed and signed

by Executor or Administrator.

Your SSN:

Spouse’s SSN:

Filing Status

1. Single

2. Married Filing Jointly

3. Married Filing Separately

4. Head of Household

5. Widow(er) with Dependent Child

You Spouse

Year spouse died:

Return for deceased taxpayer

Date of death:

Select box if you or your spouse were a nonresident of NC for the entire year.

Return for deceased spouse

Date of death:

Select box if you or your spouse moved into or out of NC during the year.

N.C. Education Endowment Fund: You may contribute to the N.C. Education Endowment Fund by making a contribution or designating some or all of

your overpayment to the Fund. To make a contribution, enclose Form NC-EDU and your payment of

$

.

To designate your overpayment

to the Fund, enter the amount of your designation on Page 2, Line 28. See instructions for information about the Fund.

N

N

FS

PP

DT

OC

TD

DS

EA

N

SD

0

06

18

23B

0

07

18

23C

20A

0

09

23E

11

20B

EU

11

21A

24

00000

21B

13

26

0

21C

14

27

21D

0

15

28

23A

16

30

TN

PN

PP

Sign Return Below

Refund Due

Payment Due

If prepared by a person other than taxpayer, this certification is based on all information of

I certify that, to the best of my knowledge, this return is accurate and complete.

which the preparer has any knowledge.

Your Signature

Date

Spouse’s Signature (If filing joint return, both must sign.)

Date

Paid Preparer’s Signature

Date

Home Telephone Number (Include area code)

Paid Preparer’s FEIN, SSN, or PTIN

Paid Preparer’s Telephone Number

If you ARE NOT due a refund, mail return, any payment, and Form D-400V to: NCDOR, P.O. Box 25000, Raleigh, N.C. 27640-0640

If REFUND mail to: NCDOR, P.O. Box R, Raleigh, N.C. 27634-0001

1

1 2

2