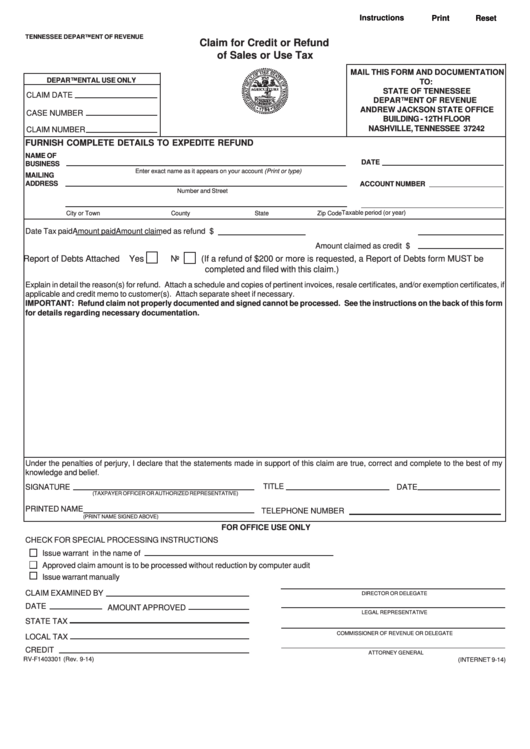

Instructions

Print

Reset

TENNESSEE DEPARTMENT OF REVENUE

Claim for Credit or Refund

of Sales or Use Tax

MAIL THIS FORM AND DOCUMENTATION

DEPARTMENTAL USE ONLY

TO:

STATE OF TENNESSEE

CLAIM DATE

DEPARTMENT OF REVENUE

ANDREW JACKSON STATE OFFICE

CASE NUMBER

BUILDING - 12TH FLOOR

NASHVILLE, TENNESSEE 37242

CLAIM NUMBER

FURNISH COMPLETE DETAILS TO EXPEDITE REFUND

NAME OF

DATE

BUSINESS

Enter exact name as it appears on your account (Print or type)

MAILING

ADDRESS

ACCOUNT NUMBER

P.O. Box or Number and Street

Taxable period (or year)

City or Town

County

State

Zip Code

Date Tax paid

Amount paid

Amount claimed as refund $

Amount claimed as credit $

Report of Debts Attached Yes

No

(If a refund of $200 or more is requested, a Report of Debts form MUST be

completed and filed with this claim.)

Explain in detail the reason(s) for refund. Attach a schedule and copies of pertinent invoices, resale certificates, and/or exemption certificates, if

applicable and credit memo to customer(s). Attach separate sheet if necessary.

IMPORTANT: Refund claim not properly documented and signed cannot be processed. See the instructions on the back of this form

for details regarding necessary documentation.

Under the penalties of perjury, I declare that the statements made in support of this claim are true, correct and complete to the best of my

knowledge and belief.

TITLE

SIGNATURE

DATE

(TAXPAYER OFFICER OR AUTHORIZED REPRESENTATIVE)

PRINTED NAME

TELEPHONE NUMBER

(PRINT NAME SIGNED ABOVE)

FOR OFFICE USE ONLY

CHECK FOR SPECIAL PROCESSING INSTRUCTIONS

Issue warrant in the name of

Approved claim amount is to be processed without reduction by computer audit

Issue warrant manually

CLAIM EXAMINED BY

DIRECTOR OR DELEGATE

DATE

AMOUNT APPROVED

LEGAL REPRESENTATIVE

STATE TAX

COMMISSIONER OF REVENUE OR DELEGATE

LOCAL TAX

CREDIT

ATTORNEY GENERAL

RV-F1403301 (Rev. 9-14)

(INTERNET 9-14)

1

1 2

2