Clear Fields

Print Form

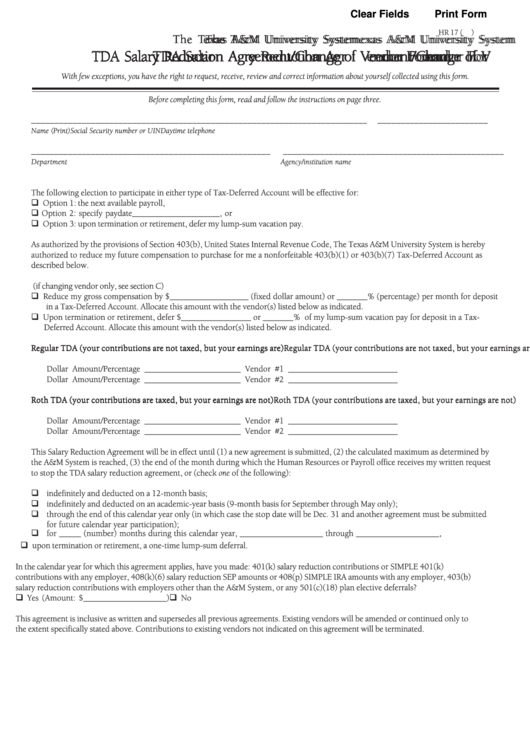

HR 17 (

)

The T

The T

The T

The T

The Texas A&M University System

exas A&M University System

exas A&M University System

exas A&M University System

exas A&M University System

TDA Salar

TDA Salar

TDA Salar

TDA Salar

TDA Salary Reduction Agr

y Reduction Agr

y Reduction Agr

y Reduction Agreement/Change of V

y Reduction Agr

eement/Change of V

eement/Change of V

eement/Change of Vendor For

eement/Change of V

endor For

endor For

endor Form m m m m

endor For

With few exceptions, you have the right to request, receive, review and correct information about yourself collected using this form.

Before completing this form, read and follow the instructions on page three.

____________________________________________________

_____________________

________________________

Name (Print)

Social Security number or UIN

Daytime telephone

____________________________________________________

________________________________________________

Department

Agency/institution name

A. EFFECTIVE DATE

The following election to participate in either type of Tax-Deferred Account will be effective for:

Option 1: the next available payroll,

Option 2: specify paydate____________________, or

Option 3: upon termination or retirement, defer my lump-sum vacation pay.

As authorized by the provisions of Section 403(b), United States Internal Revenue Code, The Texas A&M University System is hereby

authorized to reduce my future compensation to purchase for me a nonforfeitable 403(b)(1) or 403(b)(7) Tax-Deferred Account as

described below.

B. SELECT/CHANGE CONTRIBUTION AMOUNT AND SELECT VENDOR (if changing vendor only, see section C)

Reduce my gross compensation by $__________________ (fixed dollar amount) or _______% (percentage) per month for deposit

in a Tax-Deferred Account. Allocate this amount with the vendor(s) listed below as indicated.

Upon termination or retirement, defer $________________ or _______% of my lump-sum vacation pay for deposit in a Tax-

Deferred Account. Allocate this amount with the vendor(s) listed below as indicated.

Regular TDA (your contributions are not taxed, but your earnings are)

Regular TDA (your contributions are not taxed, but your earnings are)

Regular TDA (your contributions are not taxed, but your earnings are)

Regular TDA (your contributions are not taxed, but your earnings are)

Regular TDA (your contributions are not taxed, but your earnings are)

Dollar Amount/Percentage ______________________ Vendor #1 _________________________

Dollar Amount/Percentage ______________________ Vendor #2 _________________________

Roth TDA (your contributions are taxed, but your earnings are not)

Roth TDA (your contributions are taxed, but your earnings are not)

Roth TDA (your contributions are taxed, but your earnings are not)

Roth TDA (your contributions are taxed, but your earnings are not)

Roth TDA (your contributions are taxed, but your earnings are not)

Dollar Amount/Percentage ______________________ Vendor #1 _________________________

Dollar Amount/Percentage ______________________ Vendor #2 _________________________

This Salary Reduction Agreement will be in effect until (1) a new agreement is submitted, (2) the calculated maximum as determined by

the A&M System is reached, (3) the end of the month during which the Human Resources or Payroll office receives my written request

to stop the TDA salary reduction agreement, or (check one of the following):

indefinitely and deducted on a 12-month basis;

indefinitely and deducted on an academic-year basis (9-month basis for September through May only);

through the end of this calendar year only (in which case the stop date will be Dec. 31 and another agreement must be submitted

for future calendar year participation);

for _____ (number) months during this calendar year, ___________________ through ___________________,

upon termination or retirement, a one-time lump-sum deferral.

In the calendar year for which this agreement applies, have you made: 401(k) salary reduction contributions or SIMPLE 401(k)

contributions with any employer, 408(k)(6) salary reduction SEP amounts or 408(p) SIMPLE IRA amounts with any employer, 403(b)

salary reduction contributions with employers other than the A&M System, or any 501(c)(18) plan elective deferrals?

Yes (Amount: $___________________)

No

This agreement is inclusive as written and supersedes all previous agreements. Existing vendors will be amended or continued only to

the extent specifically stated above. Contributions to existing vendors not indicated on this agreement will be terminated.

1

1 2

2 3

3