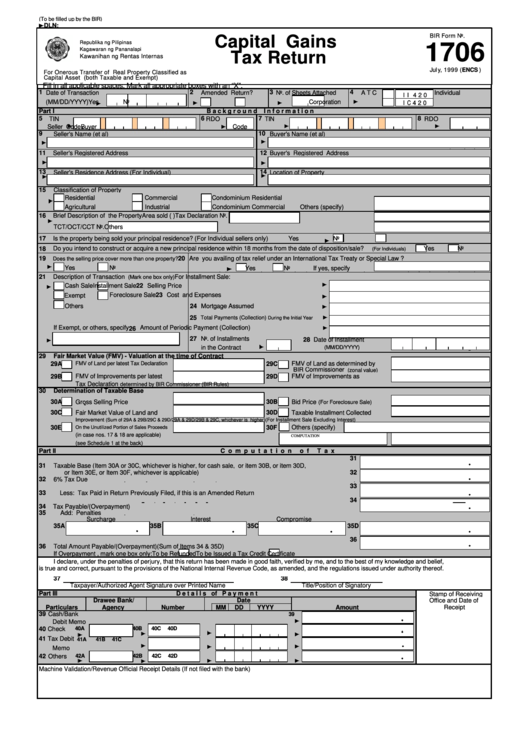

Capital Gains Tax Return

ADVERTISEMENT

(To be filled up by the BIR)

DLN:

BIR Form No.

Capital Gains

Republika ng Pilipinas

1706

Kagawaran ng Pananalapi

Tax Return

Kawanihan ng Rentas Internas

Jul y, 1999 (ENCS )

For Onerous Transfer of Real Property Classified as

Capital Asset (both Taxable and Exempt)

Fill in all applicable spaces. Mark all appropriate boxes with an “X”.

1 Date of Transaction

2

Amended Return?

3 No. of Sheets Attached

4

A T C

Individual

I I 4 2 0

I C 4 2 0

(MM/DD/YYYY)

Yes

No

Corporation

Part I

B a c k g r o u n d

I n f o r m a t i o n

5

TIN

6 RDO

7 TIN

8 RDO

Seller

Code

Buyer

Code

9

Seller's Name (et al)

10 Buyer's Name (et al)

11

Seller's Registered Address

12 Buyer's Registered Address

13

Seller's Residence Address (For Individual)

14 Location of Property

15

Classification of Property

Residential

Commercial

Condominium Residential

Agricultural

Industrial

Condominium Commercial

Others (specify)

16

Brief Description of the Property

Area sold (sq.m.)

Tax Declaration No.

TCT/OCT/CCT No.

Others

17

Is the property being sold your principal residence? (For Individual sellers only)

Yes

No

Do you intend to construct or acquire a new principal residence within 18 months from the date of disposition/sale?

Yes

No

18

(For Individuals)

19

20 Are you availing of tax relief under an International Tax Treaty or Special Law ?

Does the selling price cover more than one property?

Yes

No

Yes

No

If yes, specify

21

Description of Transaction

For Installment Sale:

(Mark one box only)

Cash Sale

Installment Sale

22 Selling Price

Exempt

Foreclosure Sale

23 Cost and Expenses

Others

24 Mortgage Assumed

25

Total Payments (Collection)

During the Initial Year

If Exempt, or others, specify

26 Amount of Periodic Payment (Collection)

27 No. of Installments

28 Date of Installment

in the Contract

(MM/DD/YYYY)

29

Fair Market Value (FMV) - Valuation at the time of Contract

29A

29C

FMV of Land as determined by

FMV of Land per latest Tax Declaration

BIR Commissioner

(zonal value)

29B

FMV of Improvements per latest

29D

FMV of Improvements as

Tax Declaration

determined by BIR Commissioner (BIR Rules)

30

Determination of Taxable Base

30A

Gross Selling Price

30B

Bid Price

(For Foreclosure Sale)

30C

Fair Market Value of Land and

30D

Taxable Installment Collected

Improvement (Sum of 29A & 29B/29C & 29D/29A & 29D/29B & 29C, whichever is higher)

(For Installment Sale Excluding Interest)

30E

30F

Others (specify)

On the Unutilized Portion of Sales Proceeds

(in case nos. 17 & 18 are applicable)

COMPUTATION

(see Schedule 1 at the back)

Part II

C o m p u t a t i o n

o f

T a x

31

31

Taxable Base (Item 30A or 30C, whichever is higher, for cash sale, or item 30B, or item 30D,

or Item 30E, or Item 30F, whichever is applicable)

32

32

6% Tax Due

33

33

Less: Tax Paid in Return Previously Filed, if this is an Amended Return

34

34

Tax Payable/(Overpayment)

35

Add: Penalties

Surcharge

Interest

Compromise

35A

35B

35C

35D

36

36

Total Amount Payable/(Overpayment)(Sum of Items 34 & 35D)

If Overpayment , mark one box only:

To be Refunded

To be Issued a Tax Credit Certificate

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

37

38

Taxpayer/Authorized Agent Signature over Printed Name

Title/Position of Signatory

Part III

D e t a i l s of P a y m e n t

Stamp of Receiving

Drawee Bank/

Date

Office and Date of

Particulars

Agency

Number

MM

DD

YYYY

Amount

Receipt

39 Cash/Bank

39

Debit Memo

40A

40B

40C

40D

40 Check

41 Tax Debit

41A

41B

41C

Memo

42A

42B

42C

42D

42 Others

Machine Validation/Revenue Official Receipt Details (If not filed with the bank)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2