Form 4563 - Exclusion Of Income For Bona Fide Residents Of American Samoa (1992)

ADVERTISEMENT

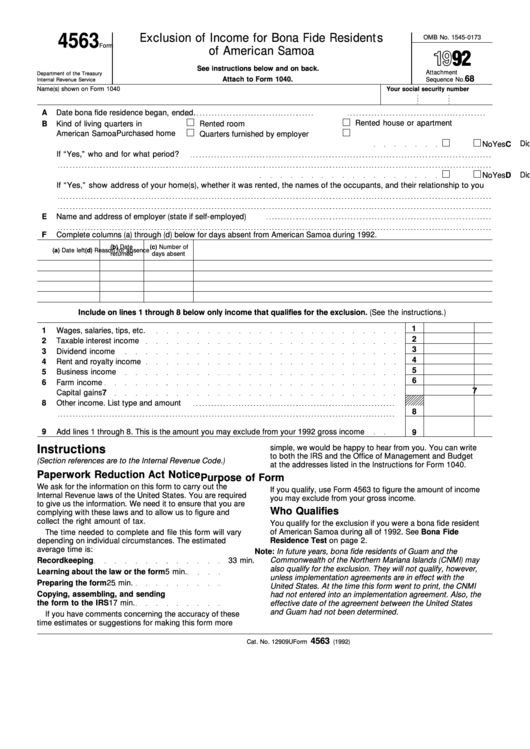

4563

Exclusion of Income for Bona Fide Residents

OMB No. 1545-0173

Form

of American Samoa

See instructions below and on back.

Attachment

Department of the Treasury

68

Attach to Form 1040.

Sequence No.

Internal Revenue Service

Your social security number

Name(s) shown on Form 1040

A

Date bona fide residence began

, ended

.

Rented house or apartment

Rented room

B

Kind of living quarters in

American Samoa

Purchased home

Quarters furnished by employer

Did any of your family live with you in American Samoa during any part of the tax year?

C

Yes

No

If “Yes,” who and for what period?

Did you maintain any home(s) outside American Samoa?

D

Yes

No

If “Yes,” show address of your home(s), whether it was rented, the names of the occupants, and their relationship to you

Name and address of employer (state if self-employed)

E

F

Complete columns (a) through (d) below for days absent from American Samoa during 1992.

(b) Date

(c) Number of

(a) Date left

(d) Reason for absence

returned

days absent

Include on lines 1 through 8 below only income that qualifies for the exclusion. (See the instructions.)

1

1

Wages, salaries, tips, etc.

2

2

Taxable interest income

3

3

Dividend income

4

4

Rent and royalty income

5

5

Business income

6

6

Farm income

7

7

Capital gains

8

Other income. List type and amount

8

9

Add lines 1 through 8. This is the amount you may exclude from your 1992 gross income

9

Instructions

simple, we would be happy to hear from you. You can write

to both the IRS and the Office of Management and Budget

(Section references are to the Internal Revenue Code.)

at the addresses listed in the Instructions for Form 1040.

Paperwork Reduction Act Notice

Purpose of Form

We ask for the information on this form to carry out the

If you qualify, use Form 4563 to figure the amount of income

Internal Revenue laws of the United States. You are required

you may exclude from your gross income.

to give us the information. We need it to ensure that you are

Who Qualifies

complying with these laws and to allow us to figure and

collect the right amount of tax.

You qualify for the exclusion if you were a bona fide resident

The time needed to complete and file this form will vary

of American Samoa during all of 1992. See Bona Fide

Residence Test on page 2.

depending on individual circumstances. The estimated

average time is:

Note: In future years, bona fide residents of Guam and the

Commonwealth of the Norther n Mar iana Islands ( CNMI) may

Recordkeeping

33 min.

also qualify for the exclusion. They will not qualify, however,

Learning about the law or the form

5 min.

unless implementation agreements are in effect with the

Preparing the form

25 min.

United States. At the time this for m went to pr int, the CNMI

Copying, assembling, and sending

had not entered into an implementation agreement. Also, the

the form to the IRS

17 min.

effective date of the agreement between the United States

and Guam had not been deter mined.

If you have comments concerning the accuracy of these

time estimates or suggestions for making this form more

4563

Cat. No. 12909U

Form

(1992)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2