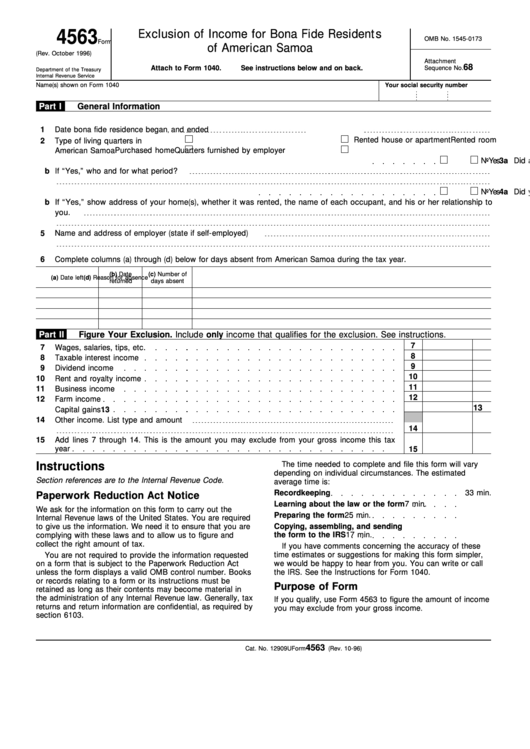

Form 4563 - Exclusion Of Income For Bona Fide Residents Of American Samoa

ADVERTISEMENT

4563

Exclusion of Income for Bona Fide Residents

OMB No. 1545-0173

Form

of American Samoa

(Rev. October 1996)

Attachment

68

Attach to Form 1040.

See instructions below and on back.

Sequence No.

Department of the Treasury

Internal Revenue Service

Name(s) shown on Form 1040

Your social security number

Part I

General Information

1

Date bona fide residence began

and ended

,

Rented room

Rented house or apartment

2

Type of living quarters in

Quarters furnished by employer

Purchased home

American Samoa

3a Did any of your family live with you in American Samoa during any part of the tax year?

Yes

No

b

If “Yes,” who and for what period?

4a Did you maintain any home(s) outside American Samoa?

Yes

No

b

If “Yes,” show address of your home(s), whether it was rented, the name of each occupant, and his or her relationship to

you.

5

Name and address of employer (state if self-employed)

6

Complete columns (a) through (d) below for days absent from American Samoa during the tax year.

(b) Date

(c) Number of

(a) Date left

(d) Reason for absence

returned

days absent

Part II

Figure Your Exclusion. Include only income that qualifies for the exclusion. See instructions.

7

7

Wages, salaries, tips, etc.

8

8

Taxable interest income

9

9

Dividend income

10

10

Rent and royalty income

11

11

Business income

12

12

Farm income

13

13

Capital gains

14

Other income. List type and amount

14

15

Add lines 7 through 14. This is the amount you may exclude from your gross income this tax

year

15

Instructions

The time needed to complete and file this form will vary

depending on individual circumstances. The estimated

Section references are to the Internal Revenue Code.

average time is:

Recordkeeping

33 min.

Paperwork Reduction Act Notice

Learning about the law or the form

7 min.

We ask for the information on this form to carry out the

Preparing the form

25 min.

Internal Revenue laws of the United States. You are required

to give us the information. We need it to ensure that you are

Copying, assembling, and sending

complying with these laws and to allow us to figure and

the form to the IRS

17 min.

collect the right amount of tax.

If you have comments concerning the accuracy of these

time estimates or suggestions for making this form simpler,

You are not required to provide the information requested

on a form that is subject to the Paperwork Reduction Act

we would be happy to hear from you. You can write or call

unless the form displays a valid OMB control number. Books

the IRS. See the Instructions for Form 1040.

or records relating to a form or its instructions must be

Purpose of Form

retained as long as their contents may become material in

the administration of any Internal Revenue law. Generally, tax

If you qualify, use Form 4563 to figure the amount of income

returns and return information are confidential, as required by

you may exclude from your gross income.

section 6103.

4563

Cat. No. 12909U

Form

(Rev. 10-96)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2