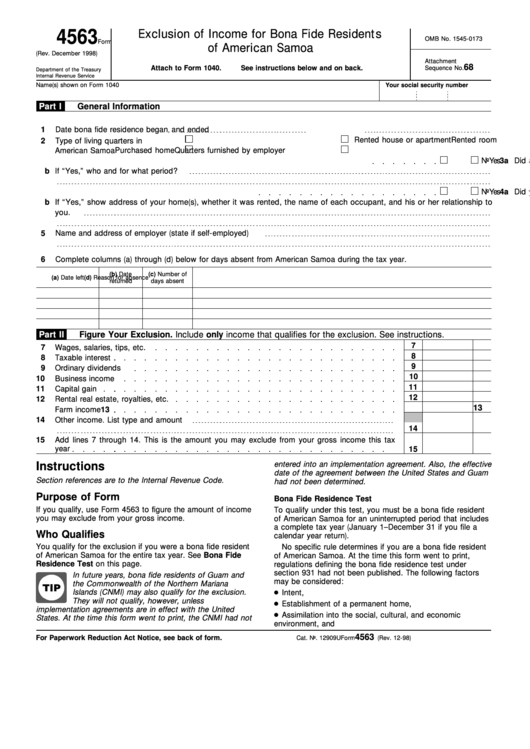

4563

Exclusion of Income for Bona Fide Residents

OMB No. 1545-0173

Form

of American Samoa

(Rev. December 1998)

Attachment

68

Attach to Form 1040.

See instructions below and on back.

Sequence No.

Department of the Treasury

Internal Revenue Service

Name(s) shown on Form 1040

Your social security number

Part I

General Information

1

Date bona fide residence began

and ended

,

Rented room

Rented house or apartment

2

Type of living quarters in

Quarters furnished by employer

Purchased home

American Samoa

3a Did any of your family live with you in American Samoa during any part of the tax year?

Yes

No

b

If “Yes,” who and for what period?

4a Did you maintain any home(s) outside American Samoa?

Yes

No

b

If “Yes,” show address of your home(s), whether it was rented, the name of each occupant, and his or her relationship to

you.

5

Name and address of employer (state if self-employed)

6

Complete columns (a) through (d) below for days absent from American Samoa during the tax year.

(b) Date

(c) Number of

(a) Date left

(d) Reason for absence

returned

days absent

Part II

Figure Your Exclusion. Include only income that qualifies for the exclusion. See instructions.

7

7

Wages, salaries, tips, etc.

8

8

Taxable interest

9

9

Ordinary dividends

10

10

Business income

11

11

Capital gain

12

12

Rental real estate, royalties, etc.

13

13

Farm income

14

Other income. List type and amount

14

15

Add lines 7 through 14. This is the amount you may exclude from your gross income this tax

year

15

Instructions

entered into an implementation agreement. Also, the effective

date of the agreement between the United States and Guam

Section references are to the Inter nal Revenue Code.

had not been deter mined.

Purpose of Form

Bona Fide Residence Test

If you qualify, use Form 4563 to figure the amount of income

To qualify under this test, you must be a bona fide resident

you may exclude from your gross income.

of American Samoa for an uninterrupted period that includes

a complete tax year (January 1–December 31 if you file a

Who Qualifies

calendar year return).

You qualify for the exclusion if you were a bona fide resident

No specific rule determines if you are a bona fide resident

of American Samoa for the entire tax year. See Bona Fide

of American Samoa. At the time this form went to print,

Residence Test on this page.

regulations defining the bona fide residence test under

section 931 had not been published. The following factors

In future years, bona fide residents of Guam and

may be considered:

the Commonwealth of the Northern Mariana

Islands ( CNMI) may also qualify for the exclusion.

Intent,

They will not qualify, however, unless

Establishment of a permanent home,

implementation agreements are in effect with the United

Assimilation into the social, cultural, and economic

States. At the time this for m went to print, the CNMI had not

environment, and

4563

For Paperwork Reduction Act Notice, see back of form.

Cat. No. 12909U

Form

(Rev. 12-98)

1

1 2

2