Form Tr1 - Tax Registration Page 3

ADVERTISEMENT

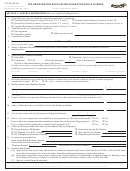

Part A continued

General Details

29. If you rent your business premises, state - Name and private address

of the landlord (not an estate agent or rent collector)

The amount of rent paid per

week

month

year

(tick R frequency)

€

The date on which you started paying the rent

D D M M Y Y Y Y

The length of the agreed rental/lease period.

30. If you acquired the business from a previous owner, state

The name and current address of the person

from whom you acquired it

The VAT/registered number of that person

Part B

Registration for Income Tax (non-PAYE)

31. If you are registering for Income Tax tick R the box

and indicate your main source of income below:

32. Trade

Foreign Income (incl. Salary & Pension)

Rental Income

Investment Income

Other

Specify

33. State your bank or building society account to which Income Tax refunds can be made:

Bank/Building Society

Branch Address

IBAN

(Max. 34 characters)

BIC

(Max. 11 characters)

Part C

Registration for VAT

34. If you are registering for VAT tick R box and complete this part

35. Registration

(a) State the date from which you require to register for VAT *

D D M M Y Y Y Y

(b) Is registration being sought only in respect of European Union (EU) acquisitions?

(This applies only to farmers and non-taxable entities) (tick R )

Yes

No

(c) Are you registering because *

(i) your turnover exceeds or is likely to exceed the limits prescribed by law

(i)

for registration? Or

(Tick either

(ii) you wish to elect to be a taxable person, (although not obliged by law

(ii)

(i), (ii) or (iii)

to be registered)? Or

as appropriate)

(iii) you are in receipt of business to business services where the reverse charge to

(iii)

VAT applies? Attach a copy of the invoice if this is the case.

36. Are you applying for the moneys received basis of accounting for

goods and services? (tick R )

Yes

No

If your answer is ‘Yes’, is this because

(a) expected annual turnover will be less than €2,000,000,

(a)

(Tick either

(a) or (b) as

(b) at least 90% of your expected annual turnover will come from supplying goods and

(b)

appropriate)

services to persons who are not registered, e.g. hospitals, schools or the general public

37. State the expected annual turnover from supplies of taxable goods or services within the State *

€

38. State your bank or building society account to which refunds can be made:

Bank/Building Society

Branch Address

IBAN

(Max. 34 characters)

BIC

(Max. 11 characters)

39. Developer/Landlord - Property details for VAT purposes

(a) Address of the property

(b) Date purchased or when development commenced

D D M M Y Y Y Y

3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4