Form Tr1 - Tax Registration Page 4

ADVERTISEMENT

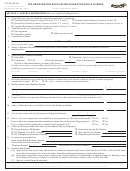

Part C continued

Registration for VAT

39. (c) Planning permission reference number, if applicable

(d) A signed statement from you/your client confirming that the property in question will be purchased and/or developed and

will be disposed of or used in a manner which will give rise to a VAT liability, e.g., by sale of the property or by exercising

the Landlord’s ‘option to tax’.

In the case of a partnership, the statement should be signed by the precedent acting partner.

Part D

Registration as an Employer for PAYE/PRSI

40. If you are registering as an employer for PAYE/PRSI tick R box and complete this part

41. Persons Engaged

(a) How many employees are:

Full time - usually working 30 hours or more per week?

Part time - usually working less than 30 hours per week?

(b) State the date your first employee commenced or will commence in your employment *

D D M M Y Y Y Y

42. What payroll and PAYE/PRSI record system will you use? (tick R the relevant box)

(a) Computer System

If you are using a computerised payroll package you should register for the Revenue

On-Line service (ROS) at to receive electronic copies of Tax Credit

Certificates and to file your P35 End of Year Return on-line.

(b) Other Manual System

Wages books are available from Office Suppliers/Stationery Bookstores

43. Correspondence on PAYE/PRSI

If correspondence relating to PAYE/PRSI is being dealt with by an agent, tick R this box

and give the following

details if different from Panel 27.

Name

Phone number

Address

E-Mail

Mobile phone number

Tax Adviser Identification

Client’s Reference

Number (TAIN)

Part E

Registration for Relevant Contracts Tax

(RCT)

Note that Principal Contractors are obliged to use Revenue’s Online Service to fulfill their RCT obligations.

Principal Contractors are obliged to register and account for VAT in relation to Construction Services under the VAT

Reverse Charge rules. Please refer to Part C of this form, Registration for VAT). Detailed information on RCT and VAT,

including guides on Principal Contractor obligations, is available on the Revenue website

44. Are you applying to register as a (tick R relevant box): *

(a) Principal only

(b) Principal & Subcontractor

(c) Subcontractor only

If (a) or (b) applies please provide the number of subcontractors engaged.

D D M M Y Y Y Y

45. Date of commencement for RCT *

46. If you are a Principal Contractor have you registered for ROS, or have you

Yes

No

an agent willing to carry out all RCT functions who is registered for ROS?

State the Tax Advisor Identification Number (TAIN) of your agent, if applicable

47. Have you previously registered with Revenue as a Principal?

Yes

No

D D M M Y Y Y Y

48. If so, state the date you last ceased to be a Principal

Additional Information

If you require further information please contact your local Revenue office or Employer Helpline at LoCall 1890 25 45 65. If you

want information on payment options, including Direct Debit, contact the Collector-General at LoCall 1890 20 30 70. Revenue

On-Line Service (ROS) Save time – File On-Line. Once registered, you can access your tax details and file returns on-line

using Revenue On-Line Service (ROS). ROS is available 24 hours a day, 365 days a year. It is easy, instant and secure. You

can access ROS and get more information at . Forms and Leaflets service LoCall 1890 306 706 (24/7/365)

Declaration

This must be made in every case before you can be registered for any tax

I declare that the particulars supplied by me in this application are true in every respect

NAME*

SIGNATURE*

(in BLOCK LETTERS)

CAPACITY*

DATE*

D D M M Y Y Y Y

(Individual, secretary, precedent partner, trustee, etc.)

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4