Vendor Information

Download a blank fillable Vendor Information in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Vendor Information with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

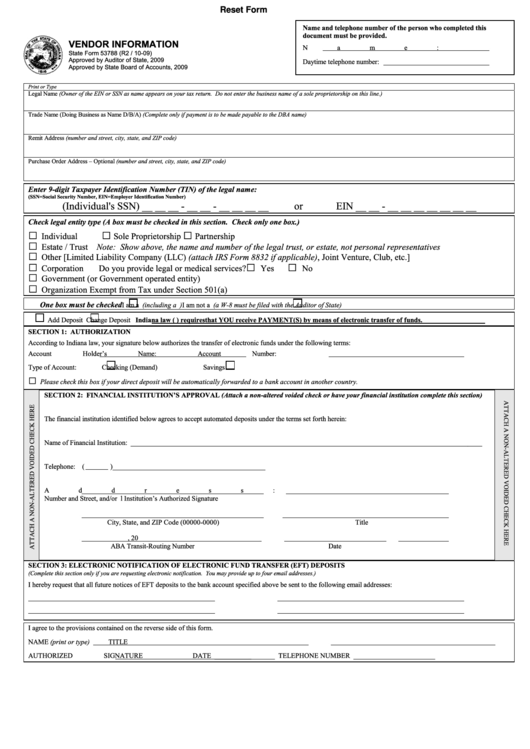

Reset Form

Name and telephone number of the person who completed this

document must be provided.

VENDOR INFORMATION

Name:

State Form 53788 (R2 / 10-09)

Approved by Auditor of State, 2009

Daytime telephone number:

Approved by State Board of Accounts, 2009

Print or Type

Legal Name (Owner of the EIN or SSN as name appears on your tax return. Do not enter the business name of a sole proprietorship on this line.)

Trade Name (Doing Business as Name D/B/A) (Complete only if payment is to be made payable to the DBA name)

Remit Address (number and street, city, state, and ZIP code)

Purchase Order Address – Optional (number and street, city, state, and ZIP code)

Enter 9-digit Taxpayer Identification Number (TIN) of the legal name:

(SSN=Social Security Number, EIN=Employer Identification Number)

(Individual's SSN) __ __ __ - __ __ - __ __ __ __

or

EIN __ __ - __ __ __ __ __ __ __

Check legal entity type (A box must be checked in this section. Check only one box.)

□

□

□

Individual

Sole Proprietorship

Partnership

□

Estate / Trust Note: Show above, the name and number of the legal trust, or estate, not personal representatives

□

Other [Limited Liability Company (LLC) (attach IRS Form 8832 if applicable), Joint Venture, Club, etc.]

□

□

□

Corporation

Do you provide legal or medical services?

Yes

No

□

Government (or Government operated entity)

□

Organization Exempt from Tax under Section 501(a)

One box must be checked

I am a U.S. Person (including a U.S. resident alien)

I am not a U.S. Person (a W-8 must be filed with the Auditor of State)

Add Deposit

Change Deposit Indiana law (I.C. 4-13-2-14.8) requires that YOU receive PAYMENT(S) by means of electronic transfer of funds.

SECTION 1: AUTHORIZATION

According to Indiana law, your signature below authorizes the transfer of electronic funds under the following terms:

Account Holder’s Name:

Account Number:

Type of Account:

Checking (Demand)

Savings

□

Please check this box if your direct deposit will be automatically forwarded to a bank account in another country.

SECTION 2: FINANCIAL INSTITUTION’S APPROVAL (Attach a non-altered voided check or have your financial institution complete this section)

The financial institution identified below agrees to accept automated deposits under the terms set forth herein:

Name of Financial Institution: ___________________________________________________________________________________________________

Telephone: (

)___________________________________________

Address:

Number and Street, and/or P.O. Box No.

Financial Institution’s Authorized Signature

City, State, and ZIP Code (00000-0000)

Title

, 20

ABA Transit-Routing Number

Date

SECTION 3: ELECTRONIC NOTIFICATION OF ELECTRONIC FUND TRANSFER (EFT) DEPOSITS

(Complete this section only if you are requesting electronic notification. You may provide up to four email addresses.)

I hereby request that all future notices of EFT deposits to the bank account specified above be sent to the following email addresses:

I agree to the provisions contained on the reverse side of this form.

NAME (print or type)

TITLE

AUTHORIZED SIGNATURE

DATE _________________ TELEPHONE NUMBER _______________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2