Vendor Information Page 2

Download a blank fillable Vendor Information in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Vendor Information with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

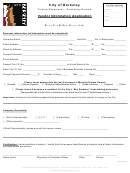

REQUEST FOR VENDOR INFORMATION

THIS FORM APPLIES TO YOU, IF YOU ARE:

1)

A U.S. person (including a U.S. resident alien); and

2)

A person, business, or other entity who has or will receive a payment from the state; or

3)

A state employee who has or will receive a payment, other than payroll, from the state.

PURPOSE OF FORM:

The Auditor of State of Indiana (Auditor) must have correct vendor information to make payments to vendors. This includes the vendor’s legal

name, doing business as name (if any), address, Taxpayer Identification Number (TIN), entity type, and banking information. This form allows you

to provide your correct name, address, TIN, entity type, and banking information.

If you do not provide us with the information, your payments may be subject to federal income tax withholding. In addition, if you do not provide us

with this information, you may be subject to a penalty imposed by the Internal Revenue Service per I.R.C. 6723.

Federal law on withholding preempts any state and local law remedies, such as any rights to a mechanic’s lien. If you do not furnish a valid TIN, we

are required to withhold a percentage of our payment to you. Withholding is not a failure to pay you. It is an advance tax payment. You should

report all withholdings as a credit for taxes paid on your federal income tax return.

INSTRUCTIONS:

1)

Enter your legal name on the designated line. Your legal name is the one that appears on your Social Security Card or, if you are a business, the

Employer Identification Number (EIN) as it is in the IRS records. If you are a sole proprietor, then your legal name is the business owner’s

name. If you have a “doing business as” (d/b/a) name, enter this on the trade name line. Enter your remit address on the next line, and if you

have a separate address for purchase orders, enter that address on the appropriate line.

2)

Record the appropriate TIN in the space provided and check the box that corresponds to the correct organization type for your name. Note that

individuals and sole proprietors are the only types that should record a social security number (SSN). a) If you are a corporation, you must

indicate whether you provide legal or medical services. b) If you are a sole proprietor, you must show the business owner’s name in the legal

name box and you may show the business name in the trade name box. You cannot use only the business name. For a sole proprietor, you may

use either the individual’s SSN or the EIN of the business. However, we prefer you provide the SSN.

3)

Check the appropriate box that indicates whether you are or are not a U.S. person.

4)

Complete Section 1: Authorization

5)

Have your financial institution complete Section 2: Financial Institution’s Approval. Your financial institution should return the completed

form to you. A voided check may be provided in lieu of having your financial institution complete this section. Attach only preprinted checks.

Deposit slips, starter checks, or checks that have been altered will not be accepted.

6)

Complete Section 3: Electronic Notification of Electronic Fund Transfer (EFT) Deposits, only if you choose to receive electronic EFT

notifications by email. If this section is not completed, your notification will be sent by U.S. Mail to the remit address designated on the reverse

side of this form.

7)

Fax the completed form to (317) 234-1916 or mail to the Indiana Auditor of State, 240 Statehouse, 200 W. Washington St., Indianapolis, IN

46204.

8)

Retain a copy of the completed form for your records.

9)

Any form submitted without an authorized signature will be destroyed and will not be entered into the Auditor’s vendor file.

BY SIGNING THIS FORM:

You represent that you understand and agree that:

1)

You are authorized to provide this information on behalf of yourself or your organization.

2)

The State of Indiana is authorized to initiate credits (deposits) in various amounts, by EFT through automated clearing house (ACH) processes,

to the checking (demand) or savings account in the financial institution designated on the reverse side of this form.

3)

If necessary, you will accept reversals from the State for any credit entries made in error to a bank account per National Automated Clearing

House Association (NACHA) regulations.

4)

You may only revoke this request and authorization by notifying the Auditor in writing, at the above address, at least fifteen (15) days before the

effective date of revocation.

5)

Any change to the account or to a new financial institution will require a new Vendor Information form be completed and submitted to the

Auditor of State at the above address. Failure to provide timely notification to the Auditor that your account has changed will result in a delay

in payment.

6)

The State of Indiana and its entities are not liable for late payment penalties or interest if you fail to provide information necessary for an EFT

transaction and/or you do not properly follow the Instructions above.

7)

The email addresses provided in Section 3 for electronic EFT notification will allow for appropriate application of all payments.

8)

You acknowledge that it will cause disruption to the notification process if the email addresses provided for electronic EFT notification are

frequently changed or changed without promptly providing an updated email address to the Auditor.

9)

You acknowledge that an email notification returned as undeliverable may be removed from the Auditor’s email notification system and all

future notices of EFT deposits to you will be provided by the Auditor via U.S. Mail to the remit address designated on the reverse side of this

form until you have provided a valid email address to the Auditor.

10) You are responsible for contacting the Auditor if you are not receiving electronic notices of EFT deposits.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2