Trcf-1000 Property Tax Rebate Program (Nazareth Area School District) - 2016

ADVERTISEMENT

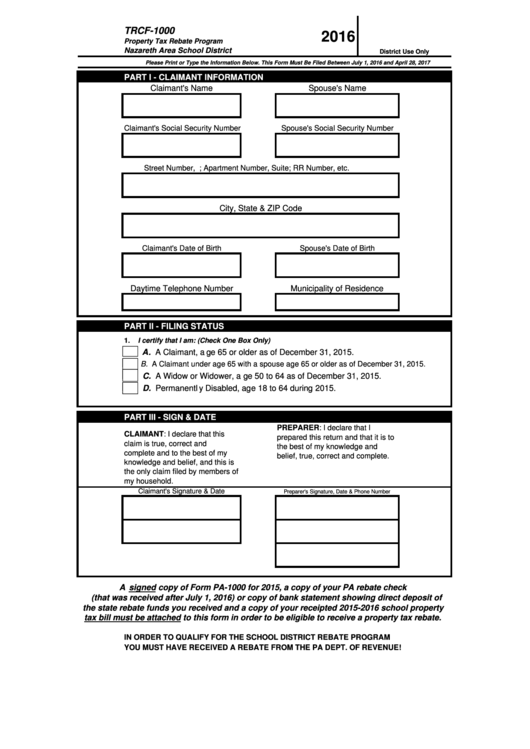

TRCF-1000

2016

Property Tax Rebate Program

Nazareth Area School District

District Use Only

Please Print or Type the Information Below. This Form Must Be Filed Between July 1, 2016 and April 28, 2017

PART I - CLAIMANT INFORMATION

Claimant's Name

Spouse's Name

Claimant's Social Security Number

Spouse's Social Security Number

Street Number, P.O. Box; Apartment Number, Suite; RR Number, etc.

City, State & ZIP Code

Claimant's Date of Birth

Spouse's Date of Birth

Daytime Telephone Number

Municipality of Residence

PART II - FILING STATUS

1.

I certify that I am: (Check One Box Only)

A. A Claimant, age 65 or older as of December 31, 2015.

B. A Claimant under age 65 with a spouse age 65 or older as of December 31, 2015.

C. A Widow or Widower, age 50 to 64 as of December 31, 2015.

D. Permanently Disabled, age 18 to 64 during 2015.

PART III - SIGN & DATE

PREPARER: I declare that I

CLAIMANT: I declare that this

prepared this return and that it is to

claim is true, correct and

the best of my knowledge and

complete and to the best of my

belief, true, correct and complete.

knowledge and belief, and this is

the only claim filed by members of

my household.

Claimant's Signature & Date

Preparer's Signature, Date & Phone Number

A signed copy of Form PA-1000 for 2015, a copy of your PA rebate check

(that was received after July 1, 2016) or copy of bank statement showing direct deposit of

the state rebate funds you received and a copy of your receipted 2015-2016 school property

tax bill must be attached to this form in order to be eligible to receive a property tax rebate.

IN ORDER TO QUALIFY FOR THE SCHOOL DISTRICT REBATE PROGRAM

YOU MUST HAVE RECEIVED A REBATE FROM THE PA DEPT. OF REVENUE!

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4