Annual Reconciliation Of Employee Earnings Tax - 2016 Page 2

ADVERTISEMENT

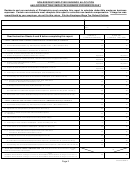

NON-RESIDENT EMPLOYEE EARNINGS ALLOCATION

AND/OR DEDUCTIBLE EMPLOYEE BUSINESS EXPENSES REPORT

Residents and non-residents of Philadelphia must complete this report to calculate deductible employee business

expenses. Certain non-residents must complete this report to calculate non-taxable compensation. If wage tax was

overwithheld by your employer, do not file this return. File the Employee Wage Tax Refund Petition.

EMPLOYER

EMPLOYEE SOCIAL SECURITY NUMBER

PLACE OF EMPLOYMENT

IF PARTIAL YEAR, PROVIDE DATES:

From

To

EMPLOYER IDENTIFICATION NUMBER (From Form W-2)

Column A

Column B

Read Instruction Sheets A and B before completing this report.

7/1/2016 to 12/31/2016

1/1/2016 to 6/30/2016

.00

1. GROSS COMPENSATION FOR EMPLOYEES PAID ON A SALARY BASIS per FORM W-2

.00

A. Non-Taxable Compensation (e.g. Stock Options) included in Line 1. (Must reflect on W-2)

.00

.00

B. Adjusted Gross Compensation (Subtract Line 1A from Line 1)

.00

.00

2. Computation of taxable compensation and/or allowable expenses

A. Number of Days/Hours (Include overtime from Line 2C)

Days/Hours

Days/Hours

B. Non-workdays/Hours (Total of weekend, vacation, holiday, sick or any type of leave time)

Days/Hours

Days/Hours

C. Number of actual Workdays/Hours (Base_______________Overtime_______________)

(Line 2A minus Line 2B)

Days/Hours

Days/Hours

D. Number of actual Days/Hours worked outside of Philadelphia in Line 2C

Days/Hours

Days/Hours

E. Percentage of time worked outside of Philadelphia (Line 2D divided by Line 2C)

%

%

F. Non-taxable gross compensation earned outside of Philadelphia (Line 1B times Line 2E)

.00

.00

G. (i) Total non-reimbursed business expenses from Form 2106 and/or

.00

.00

Schedule A, Miscellaneous Deductions, Line 21

(ii) Multiply amount on Line 2G (i) by the percentage on Line 2E

.00

.00

(iii) Deductible non-reimbursed employee business expenses. (Subtract Line 2G (ii) from Line 2G (i))

.00

.00

H. Non-taxable income and/or deductible employee business expenses (Add Line 2F and Line 2G (iii))

.00

.00

.00

.00

3. GROSS COMPENSATION FOR EMPLOYEES PAID ON A COMMISSION BASIS per FORM W-2

A. Non-Taxable Compensation (e.g. Stock Options) included in Line 3. (Must reflect on W-2)

.00

.00

B. Adjusted Gross Compensation (Subtract Line 3A from Line 3)

.00

.00

4. Computation of taxable compensation and/or allowable expenses

.00

.00

A. Total Sales

B. Sales earned outside of Philadelphia (Income Regulations 209(b))

.00

.00

C. Percentage of sales outside of Philadelphia. (Divide Line 4B by Line 4A.)

%

%

D. Commissions earned outside of Philadelphia. (Multiply Line 3B by 4C.)

.00

.00

E. (i) Total non-reimbursed business expenses from Form 2106 and/or

.00

.00

Schedule A, Miscellaneous Deductions, Line 21

(ii) Multiply amount on Line 4E (i) by the percentage on Line 4C

.00

.00

(iii) Deductible non-reimbursed employee business expenses. (Subtract Line 4E (ii) from Line 4E (i))

.00

.00

F. Non-taxable gross commissions/deductible employee business expenses. (Add Line 4D and Line 4E (iii))

.00

.00

5. TOTAL NON-TAXABLE GROSS COMPENSATION (Add Lines 2H and Line 4F from Columns A and B.)

.00

Enter here and on Line 2 of the return.

6. TAXABLE GROSS COMPENSATION (Line 1B minus Line 2H PLUS Line 3B minus Line 4F)

Residents enter Column A on Page 1, Line 4 or 5; Non-residents enter Column A on Page 1, Line 10 or 11.

.00

.00

Residents enter Column B on Page 1, Line 7 or 8; Non-residents enter Column B on Page 1, Line 13 or 14.

0215 P2 8-26-2015

Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2