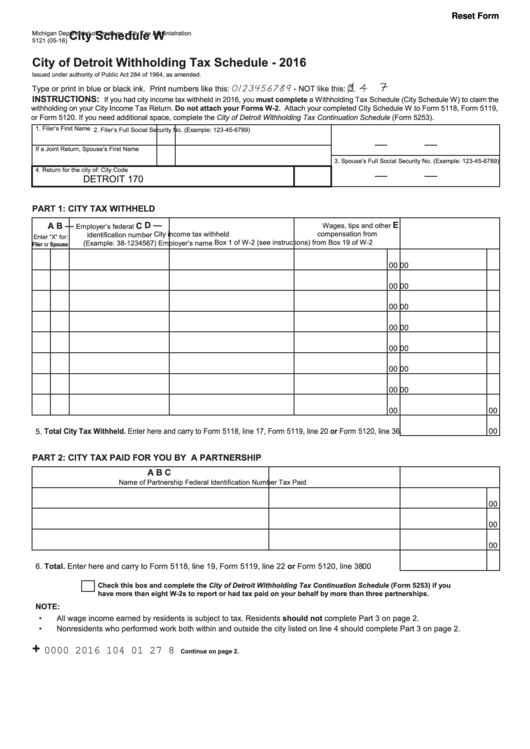

Reset Form

City Schedule W

Michigan Department of Treasury - City Tax Administration

5121 (05-16)

City of Detroit Withholding Tax Schedule - 2016

Issued under authority of Public Act 284 of 1964, as amended.

1 4

0123456789

Type or print in blue or black ink. Print numbers like this:

- NOT like this:

INSTRUCTIONS:

If you had city income tax withheld in 2016, you must complete a Withholding Tax Schedule (City Schedule W) to claim the

withholding on your City Income Tax Return. Do not attach your Forms W-2. Attach your completed City Schedule W to Form 5118, Form 5119,

or Form 5120. If you need additional space, complete the City of Detroit Withholding Tax Continuation Schedule (Form 5253).

1. Filer’s First Name

M.I.

Last Name

2. Filer’s Full Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

3. Spouse’s Full Social Security No. (Example: 123-45-6789)

4. Return for the city of:

City Code

DETROIT

170

PART 1: CITY TAX WITHHELD

D —

E

A

B —

C

Wages, tips and other

Employer’s federal

compensation from

City income tax withheld

identification number

Enter “X” for:

Box 1 of W-2 (see instructions)

from Box 19 of W-2

(Example: 38-1234567)

Employer’s name

Filer or Spouse

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

5. Total City Tax Withheld. Enter here and carry to Form 5118, line 17, Form 5119, line 20 or Form 5120, line 36.

00

PART 2: CITY TAX PAID FOR YOU BY A PARTNERSHIP

A

B

C

Name of Partnership

Federal Identification Number

Tax Paid

00

00

00

6. Total. Enter here and carry to Form 5118, line 19, Form 5119, line 22 or Form 5120, line 38. ................

00

Check this box and complete the City of Detroit Withholding Tax Continuation Schedule (Form 5253) if you

have more than eight W-2s to report or had tax paid on your behalf by more than three partnerships.

NOTE:

•

All wage income earned by residents is subject to tax. Residents should not complete Part 3 on page 2.

•

Nonresidents who performed work both within and outside the city listed on line 4 should complete Part 3 on page 2.

+

0000 2016 104 01 27 8

Continue on page 2.

1

1 2

2