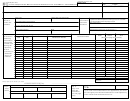

P r o p e r t y T a x

D e a l e r ’ s M o t o r V e h i c l e I n v e n t o r y T a x S t a t e m e n t

Form 50-246

Additional Instructions

Step 3: Information on each vehicle sold during the report-

Sales Price: Total amount of money paid or to be paid for the

2

ing month. Complete the information on each motor vehicle sold,

purchase of a motor vehicle as set forth as ‘‘sales price’’ in the

including the date of sale, model year, model make, vehicle iden-

form entitled ‘‘Application for Texas Certificate of Title’’ promul-

tification number, purchaser’s name, type of sale, sales price and

gated by the Texas Department of Motor Vehicles. In a transac-

unit property tax. The footnotes include:

tion that does not involve the use of that form, the term means an

amount of money that is equivalent, or substantially equivalent,

Type of Sale: Place one of the following codes by each sale

1

to the amount that would appear as ‘‘sales price’’ on the Applica-

reported:

tion for Texas Certificate of Title if that form were involved.

MV – motor vehicle inventory – sales of motor vehicles. A

Unit Property Tax: To compute, multiply the sales price by the

3

motor vehicle is a fully self-propelled vehicle with at least two

unit property tax factor. Contact either the county tax assessor-

wheels which has the primary purpose of transporting people

collector or county appraisal district for the current unit property

or property (whether or not intended for use on a public street,

tax factor. The unit property tax factor is calculated by dividing

road, or highway) and includes a towable recreational vehicle.

the prior year’s aggregate tax rate by 12. If the aggregate tax

Motor vehicle does not include: 1. vehicles with a certificate of

rate is expressed in dollars per $100 of valuation, divide by $100

title that has been surrendered in exchange for a salvage cer-

and then divide by 12. It represents one-twelfth of the preced-

tificate; nor 2. equipment or machinery designed and intended

ing year’s aggregate tax rate at the location. For fleet, dealer

for a specific work related purpose other than transporting

and subsequent sales that are not included in the motor vehicle

people or property.

inventory, the unit property tax is $-0-. If no unit property tax is

FL – fleet transactions – motor vehicles included in the sale

assigned, state the reason.

of five or more motor vehicles from inventory to the same per-

Total unit property tax for reporting month: Enter the total

4

son within one calendar year.

amount of unit property tax from the “Total for this page only” box

DL – dealer sales – sales of vehicles to another Texas dealer

on previous page(s). This is the total amount of unit property tax

or dealer who is legally recognized in another state as a motor

that will be submitted with the statement to the collector.

vehicle dealer.

SS – subsequent sales – dealer-financed sales of motor

vehicles that, at the time of sale, have dealer financing from

your motor vehicle inventory in the same calendar year.

comptroller.texas.gov/taxinfo/proptax

For more information, visit our website:

Page 4 • 50-246 • 04-15/14

1

1 2

2 3

3 4

4