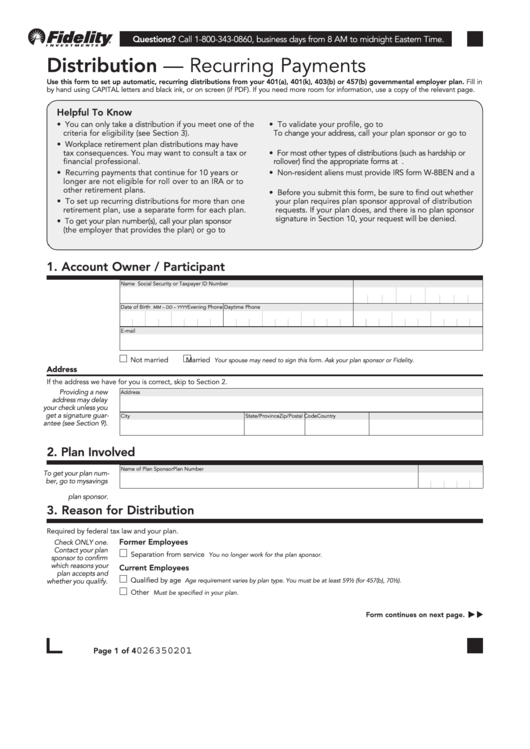

Fidelity Distribution Form

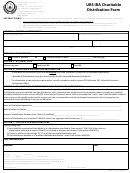

ADVERTISEMENT

Questions? Call 1-800-343-0860, business days from 8 AM to midnight Eastern Time.

Distribution — Recurring Payments

Use this form to set up automatic, recurring distributions from your 401(a), 401(k), 403(b) or 457(b) governmental employer plan. Fill in

by hand using CAPITAL letters and black ink, or on screen (if PDF). If you need more room for information, use a copy of the relevant page.

Helpful To Know

• You can only take a distribution if you meet one of the

• To validate your profile, go to

criteria for eligibility (see Section 3).

To change your address, call your plan sponsor or go to

• Workplace retirement plan distributions may have

tax consequences. You may want to consult a tax or

• For most other types of distributions (such as hardship or

rollover) find the appropriate forms at

financial professional.

• Recurring payments that continue for 10 years or

• Non-resident aliens must provide IRS form W-8BEN and a

longer are not eligible for roll over to an IRA or to

U.S. taxpayer ID number to claim any tax treaty benefits.

other retirement plans.

• Before you submit this form, be sure to find out whether

• To set up recurring distributions for more than one

your plan requires plan sponsor approval of distribution

retirement plan, use a separate form for each plan.

requests. If your plan does, and there is no plan sponsor

signature in Section 10, your request will be denied.

• To get your plan number(s), call your plan sponsor

(the employer that provides the plan) or go to

.

1. Account Owner / Participant

Name

Social Security or Taxpayer ID Number

Date of Birth

Evening Phone

Daytime Phone

mm – dd – yyyy

E-mail

Not married

Married

your spouse may need to sign this form. Ask your plan sponsor or Fidelity.

Address

If the address we have for you is correct, skip to Section 2.

Providing a new

Address

address may delay

your check unless you

get a signature guar

City

State/Province

Zip/Postal Code

Country

antee (see Section 9).

2. Plan Involved

Name of Plan Sponsor

Plan Number

To get your plan num

ber, go to mysavings

or call your

plan sponsor.

3. Reason for Distribution

Required by federal tax law and your plan.

Former Employees

Check ONLy one.

Contact your plan

Separation from service

you no longer work for the plan sponsor.

sponsor to confirm

which reasons your

Current Employees

plan accepts and

Qualified by age

whether you qualify.

Age requirement varies by plan type. you must be at least 59½ (for 457(b), 70½).

Other

must be specified in your plan.

Form continues on next page.

3.TEMDISTAWP.104

026350201

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4