Ira Distribution Form

ADVERTISEMENT

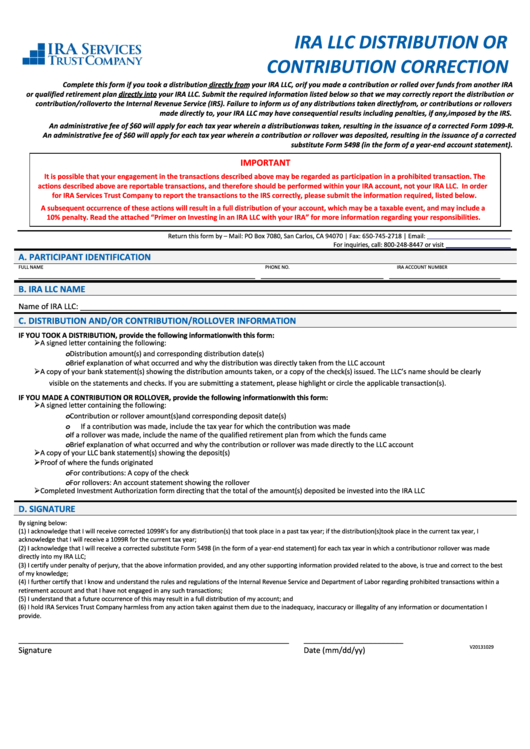

IRA LLC DISTRIBUTION OR

CONTRIBUTION CORRECTION

Complete this form if you took a distribution directly from your IRA LLC, or if you made a contribution or rolled over funds from another IRA

or qualified retirement plan directly into your IRA LLC. Submit the required information listed below so that we may correctly report the distribution or

contribution/rollover to the Internal Revenue Service (IRS). Failure to inform us of any distributions taken directly from, or contributions or rollovers

made directly to, your IRA LLC may have consequential results including penalties, if any, imposed by the IRS.

An administrative fee of $60 will apply for each tax year wherein a distribution was taken, resulting in the issuance of a corrected Form 1099-R.

An administrative fee of $60 will apply for each tax year wherein a contribution or rollover was deposited, resulting in the issuance of a corrected

substitute Form 5498 (in the form of a year-end account statement).

IMPORTANT

It is possible that your engagement in the transactions described above may be regarded as participation in a prohibited transaction. The

actions described above are reportable transactions, and therefore should be performed within your IRA account, not your IRA LLC. In order

for IRA Services Trust Company to report the transactions to the IRS correctly, please submit the information required, listed below.

A subsequent occurrence of these actions will result in a full distribution of your account, which may be a taxable event, and may include a

10% penalty. Read the attached “Primer on Investing in an IRA LLC with your IRA” for more information regarding your responsibilities.

Return this form by – Mail: PO Box 7080, San Carlos, CA 94070 | Fax: 650-745-2718 | Email:

For inquiries, call: 800-248-8447 or visit

A. PARTICIPANT IDENTIFICATION

FULL NAME

PHONE NO.

IRA ACCOUNT NUMBER

________________________________________________________ _____________________________ __________________________

B. IRA LLC NAME

Name of IRA LLC: ___________________________________________________________________________________________________

C. DISTRIBUTION AND/OR CONTRIBUTION/ROLLOVER INFORMATION

IF YOU TOOK A DISTRIBUTION, provide the following information with this form:

A signed letter containing the following:

Distribution amount(s) and corresponding distribution date(s)

o

Brief explanation of what occurred and why the distribution was directly taken from the LLC account

o

A copy of your bank statement(s) showing the distribution amounts taken, or a copy of the check(s) issued. The LLC’s name should be clearly

visible on the statements and checks. If you are submitting a statement, please highlight or circle the applicable transaction(s).

IF YOU MADE A CONTRIBUTION OR ROLLOVER, provide the following information with this form:

A signed letter containing the following:

Contribution or rollover amount(s) and corresponding deposit date(s)

o

If a contribution was made, include the tax year for which the contribution was made

o

If a rollover was made, include the name of the qualified retirement plan from which the funds came

o

Brief explanation of what occurred and why the contribution or rollover was made directly to the LLC account

o

A copy of your LLC bank statement(s) showing the deposit(s)

Proof of where the funds originated

For contributions: A copy of the check

o

For rollovers: An account statement showing the rollover

o

Completed Investment Authorization form directing that the total of the amount(s) deposited be invested into the IRA LLC

D. SIGNATURE

By signing below:

(1) I acknowledge that I will receive corrected 1099R’s for any distribution(s) that took place in a past tax year; if the distribution(s) took place in the current tax year, I

acknowledge that I will receive a 1099R for the current tax year;

(2) I acknowledge that I will receive a corrected substitute Form 5498 (in the form of a year-end statement) for each tax year in which a contribution or rollover was made

directly into my IRA LLC;

(3) I certify under penalty of perjury, that the above information provided, and any other supporting information provided related to the above, is true and correct to the best

of my knowledge;

(4) I further certify that I know and understand the rules and regulations of the Internal Revenue Service and Department of Labor regarding prohibited transactions within a

retirement account and that I have not engaged in any such transactions;

(5) I understand that a future occurrence of this may result in a full distribution of my account; and

(6) I hold IRA Services Trust Company harmless from any action taken against them due to the inadequacy, inaccuracy or illegality of any information or documentation I

provide.

________________________________________________________________

_______________________

V20131029

Signature

Date (mm/dd/yy)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2