Form 851-K - Kentucky Affiliations And Payment Schedule - Kentucky Department Of Revenue Page 2

ADVERTISEMENT

41A720-S4 (10-10)

Page 2

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

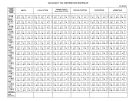

FORM 851-K—KENTUCKY AFFILIATIONS AND PAYMENT SCHEDULE

INSTRUCTIONS

Purpose of Form—This form must be completed and attached to the Kentucky Corporation Income

Tax and LLET Return (Form 720) and the Application for Six-Month Extension of Time to File Kentucky

Corporation or Limited Liability Pass-through Entity Return (Form 41A720SL) if the corporation is

fi ling an elective consolidated tax return or a mandatory nexus consolidated tax return as provided

by KRS 141.200(4) and KRS 141.200(11), respectively.

The information requested on this form identifi es the parent of the affi liated group and each

subsidiary included in the consolidated return. It is necessary in order to identify the corporations

included in the affi liated group and to avoid unnecessary correspondence from the department, such

as delinquency notices to subsidiaries.

Elective Consolidated Return—An election by an affi liated group to fi le a consolidated return as

provided by KRS 141.200(4) prior to January 1, 2005, shall be binding for a ninety-six (96) consecutive

month period, beginning with the fi rst month of the fi rst taxable year for which the election was

made and ending with the conclusion of the taxable year in which the ninety-six (96) consecutive

calendar month expires.

Mandatory Nexus Consolidated Return—For tax years beginning on or after January 1, 2005, an

affi liated group shall fi le a nexus consolidated return as provided by KRS 141.200(11) that includes

all corporations doing business in this state, except corporations excluded by KRS 141.200(9)(e) and

corporations included in an elective consolidated return whose ninety-six (96) month election period

has not expired.

Tax Payments—If this form is being fi led with Form 720, enter the total limited liability entity tax and

corporation income tax paid for the tax year on the applicable lines, including the overpayments

applied from the prior year, estimated tax payments, taxes withheld, and amounts paid with Form

41A720SL.

If this form is being fi led with Form 41A720SL, enter the total limited liability entity tax and corporation

income tax being paid with the Form 41A720SL on the applicable lines.

Stock Ownership Information—Enter the name, federal identification number and Kentucky

Corporation/LLET Account Number of the parent corporation and each subsidiary included in the

consolidated tax return. If the parent corporation has more than thirteen subsidiaries, attach additional

Forms 851-K as needed. Enter the percent of value and percent of voting power owned by a corporation

or corporations included in the affi liated group. In the Owned by Corporation No. column, enter the

number of the corporation or corporations which owns each subsidiary. For example, if subsidiary

corporation number 2 is owned by parent corporation number 1, enter 1; or if subsidiary corporation

number 2 is owned by subsidiary corporation numbers 3, 7, and 10, enter 3, 7, 10.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2