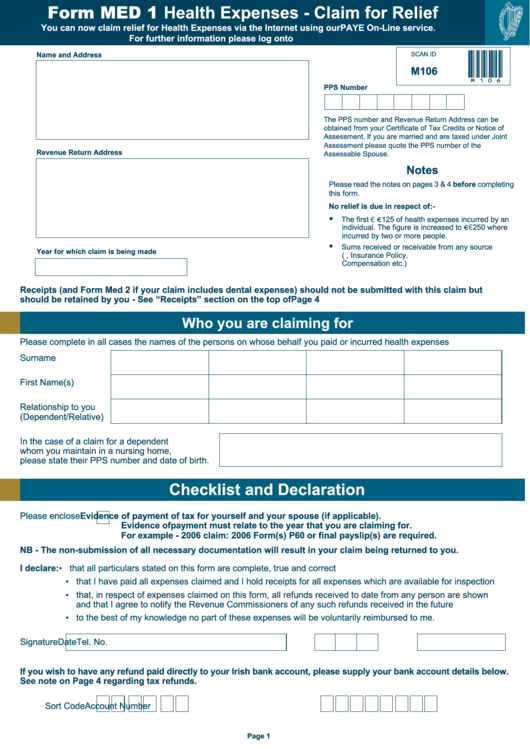

Form MED 1 Health Expenses - Claim for Relief

You can now claim relief for Health Expenses via the Internet using our PAYE On-Line service.

For further information please log onto

Name and Address

SCAN ID

M106

M106

PPS Number

The PPS number and Revenue Return Address can be

obtained from your Certificate of Tax Credits or Notice of

Assessment. If you are married and are taxed under Joint

Assessment please quote the PPS number of the

Revenue Return Address

Assessable Spouse.

Notes

Please read the notes on pages 3 & 4 before completing

this form.

No relief is due in respect of:-

The first € £ 125 of health expenses incurred by an

u

individual. The figure is increased to £€ 2 50 where

incurred by two or more people.

u

Sums received or receivable from any source

Year for which claim is being made

(e.g. Public/Local Authority, Insurance Policy,

Compensation etc.)

Receipts (and Form Med 2 if your claim includes dental expenses) should not be submitted with this claim but

should be retained by you - See “Receipts” section on the top of Page 4

Who you are claiming for

Please complete in all cases the names of the persons on whose behalf you paid or incurred health expenses

Surname

First Name(s)

Relationship to you

(Dependent/Relative)

In the case of a claim for a dependent

whom you maintain in a nursing home,

please state their PPS number and date of birth.

Checklist and Declaration

Please enclose

Evidence of payment of tax for yourself and your spouse (if applicable).

Evidence of payment must relate to the year that you are claiming for.

For example - 2006 claim: 2006 Form(s) P60 or final payslip(s) are required.

NB - The non-submission of all necessary documentation will result in your claim being returned to you.

I declare: • that all particulars stated on this form are complete, true and correct

• that I have paid all expenses claimed and I hold receipts for all expenses which are available for inspection

• that, in respect of expenses claimed on this form, all refunds received to date from any person are shown

and that I agree to notify the Revenue Commissioners of any such refunds received in the future

• to the best of my knowledge no part of these expenses will be voluntarily reimbursed to me.

Signature

Date

Tel. No.

If you wish to have any refund paid directly to your Irish bank account, please supply your bank account details below.

See note on Page 4 regarding tax refunds.

Sort Code

Account Number

Page 1

1

1 2

2 3

3 4

4