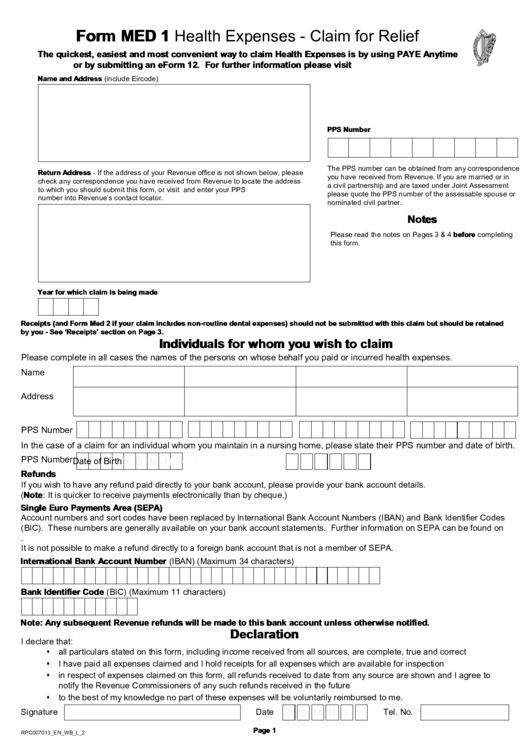

Form MED 1 Health Expenses - Claim for Relief

The quickest, easiest and most convenient way to claim Health Expenses is by using PAYE Anytime

or by submitting an eForm 12. For further information please visit

Name and Address (include Eircode)

PPS Number

The PPS number can be obtained from any correspondence

Return Address - If the address of your Revenue office is not shown below, please

you have received from Revenue. If you are married or in

check any correspondence you have received from Revenue to locate the address

a civil partnership and are taxed under Joint Assessment

to which you should submit this form, or visit and enter your PPS

please quote the PPS number of the assessable spouse or

number into Revenue’s contact locator.

nominated civil partner.

Notes

Please read the notes on Pages 3 & 4 before completing

this form.

Year for which claim is being made

Receipts (and Form Med 2 if your claim includes non-routine dental expenses) should not be submitted with this claim but should be retained

by you - See ‘Receipts’ section on Page 3.

Individuals for whom you wish to claim

Please complete in all cases the names of the persons on whose behalf you paid or incurred health expenses.

Name

Address

PPS Number

In the case of a claim for an individual whom you maintain in a nursing home, please state their PPS number and date of birth.

PPS Number

Date of Birth

D D M M Y Y

Refunds

If you wish to have any refund paid directly to your bank account, please provide your bank account details.

(Note: It is quicker to receive payments electronically than by cheque.)

Single Euro Payments Area (SEPA)

Account numbers and sort codes have been replaced by International Bank Account Numbers (IBAN) and Bank Identifier Codes

(BIC). These numbers are generally available on your bank account statements. Further information on SEPA can be found on

.

It is not possible to make a refund directly to a foreign bank account that is not a member of SEPA.

International Bank Account Number (IBAN) (Maximum 34 characters)

Bank Identifier Code (BIC) (Maximum 11 characters)

Note: Any subsequent Revenue refunds will be made to this bank account unless otherwise notified.

Declaration

I declare that:

s all particulars stated on this form, including income received from all sources, are complete, true and correct

s I have paid all expenses claimed and I hold receipts for all expenses which are available for inspection

s in respect of expenses claimed on this form, all refunds received to date from any source are shown and I agree to

notify the Revenue Commissioners of any such refunds received in the future

s to the best of my knowledge no part of these expenses will be voluntarily reimbursed to me.

Date

Tel. No.

Signature

D D M M Y Y

Page 1

RPC007013_EN_WB_L_2

1

1 2

2 3

3 4

4