Form Pa 8857 Instructions - Request For Relief From Joint Liability

ADVERTISEMENT

2

PA 8857 (10-09)

Page

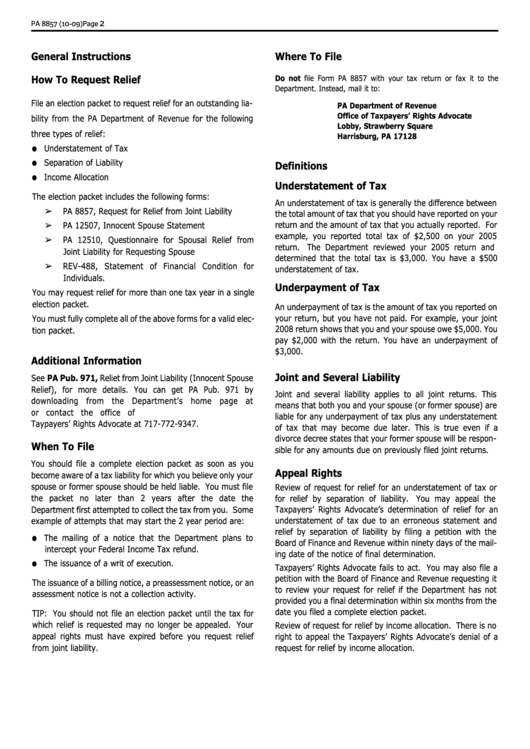

General Instructions

Where To File

Do not file Form PA 8857 with your tax return or fax it to the

How To Request Relief

Department. Instead, mail it to:

File an election packet to request relief for an outstanding lia-

PA Department of Revenue

Office of Taxpayers’ Rights Advocate

bility from the PA Department of Revenue for the following

Lobby, Strawberry Square

three types of relief:

Harrisburg, PA 17128

•

Understatement of Tax

•

Separation of Liability

Definitions

•

Income Allocation

Understatement of Tax

The election packet includes the following forms:

An understatement of tax is generally the difference between

PA 8857, Request for Relief from Joint Liability

the total amount of tax that you should have reported on your

return and the amount of tax that you actually reported. For

PA 12507, Innocent Spouse Statement

example, you reported total tax of $2,500 on your 2005

PA 12510, Questionnaire for Spousal Relief from

return.

The Department reviewed your 2005 return and

Joint Liability for Requesting Spouse

determined that the total tax is $3,000. You have a $500

REV-488, Statement of Financial Condition for

understatement of tax.

Individuals.

Underpayment of Tax

You may request relief for more than one tax year in a single

election packet.

An underpayment of tax is the amount of tax you reported on

your return, but you have not paid. For example, your joint

You must fully complete all of the above forms for a valid elec-

2008 return shows that you and your spouse owe $5,000. You

tion packet.

pay $2,000 with the return. You have an underpayment of

$3,000.

Additional Information

Joint and Several Liability

See PA Pub. 971, Reliet from Joint Liability (Innocent Spouse

Relief), for more details. You can get PA Pub. 971 by

Joint and several liability applies to all joint returns. This

downloading from the Department’s home page at

means that both you and your spouse (or former spouse) are

or contact the office of

liable for any underpayment of tax plus any understatement

Taypayers’ Rights Advocate at 717-772-9347.

of tax that may become due later. This is true even if a

divorce decree states that your former spouse will be respon-

When To File

sible for any amounts due on previously filed joint returns.

You should file a complete election packet as soon as you

Appeal Rights

become aware of a tax liability for which you believe only your

spouse or former spouse should be held liable. You must file

Review of request for relief for an understatement of tax or

the packet no later than 2 years after the date the

for relief by separation of liability.

You may appeal the

Department first attempted to collect the tax from you. Some

Taxpayers’ Rights Advocate’s determination of relief for an

example of attempts that may start the 2 year period are:

understatement of tax due to an erroneous statement and

relief by separation of liability by filing a petition with the

•

The mailing of a notice that the Department plans to

Board of Finance and Revenue within ninety days of the mail-

intercept your Federal Income Tax refund.

ing date of the notice of final determination.

•

The issuance of a writ of execution.

Taxpayers’ Rights Advocate fails to act. You may also file a

petition with the Board of Finance and Revenue requesting it

The issuance of a billing notice, a preassessment notice, or an

to review your request for relief if the Department has not

assessment notice is not a collection activity.

provided you a final determination within six months from the

date you filed a complete election packet.

TIP: You should not file an election packet until the tax for

which relief is requested may no longer be appealed. Your

Review of request for relief by income allocation. There is no

appeal rights must have expired before you request relief

right to appeal the Taxpayers’ Rights Advocate’s denial of a

from joint liability.

request for relief by income allocation.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3