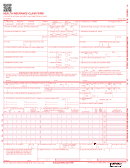

Routine Health Expenses

(See Notes)

PPS No.

n

£

Maintenance or treatment in an approved nursing home

(1)

Nursing Home

Name and Address

n

£

Non-Routine Dental Treatment (per Med 2) (See “Receipts” section at top of Page 4)

(2)

£

(a) Services of a doctor/consultant

(b) Drugs/Medicines

(where prescribed by a doctor or other qualifying practitioner)

£

Total outlay on prescribed drugs/medicines for the year

(c) Educational Psychological Assessment

£

for a dependent child (see note overleaf)

(d) Speech and Language Therapy for a

£

dependent child (see note overleaf)

£

(e) Orthoptic or similar treatment

£

(f) Diagnostic procedures (X-rays, etc.)

£

(g) Physiotherapy or similar treatment

£

(h) Expenses incurred on any medical, surgical

or nursing appliance

£

(i) Maintenance or treatment in a hospital

£

(j) Other Qualifying Expenses

(provide brief details below)

£

Total

(a) to (j)

(3)

£

TOTAL HEALTH EXPENSES

(1 + 2 + 3)

Deductions

- (If none write "NONE")

Sums received or receivable in respect of any of the above expenses

£

(i)

from any public or local authority e.g. Health Service Executive

£

(ii) under any policy of insurance e.g. VHI, BUPA, VIVAS Health, etc.

£

(iii) other e.g. compensation claim

First £125 / £250 in this tax year (delete whichever is not applicable)

£125 / £250

If this claim refers to health expenses for one person deduct £125

l

If this claim refers to two or more people deduct £250

l

TOTAL DEDUCTIONS

£

AMOUNT ON WHICH TAX RELIEF IS CLAIMED

£

(Total Health Expenses less Total Deductions)

Page 2

1

1 2

2 3

3 4

4