Sample Hardship Letter For Short Sale

ADVERTISEMENT

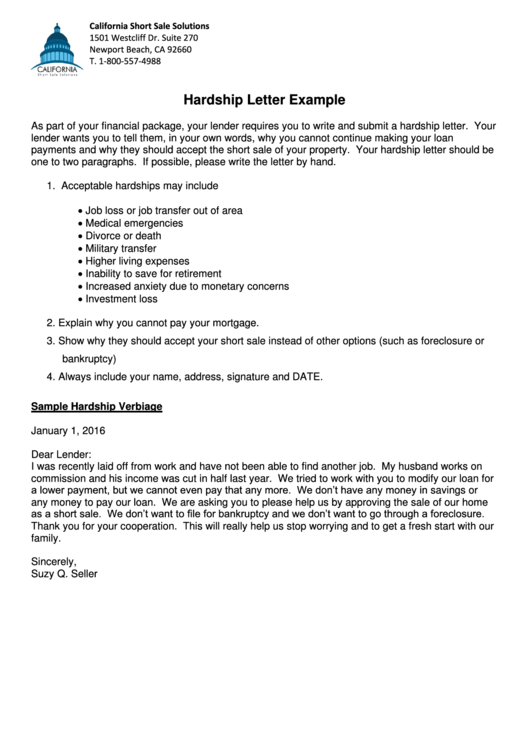

California Short Sale Solutions

1501 Westcliff Dr. Suite 270

Newport Beach, CA 92660

T. 1-800-557-4988

Hardship Letter Example

As part of your financial package, your lender requires you to write and submit a hardship letter. Your

lender wants you to tell them, in your own words, why you cannot continue making your loan

payments and why they should accept the short sale of your property. Your hardship letter should be

one to two paragraphs. If possible, please write the letter by hand.

1. Acceptable hardships may include

Job loss or job transfer out of area

Medical emergencies

Divorce or death

Military transfer

Higher living expenses

Inability to save for retirement

Increased anxiety due to monetary concerns

Investment loss

2. Explain why you cannot pay your mortgage.

3. Show why they should accept your short sale instead of other options (such as foreclosure or

bankruptcy)

4. Always include your name, address, signature and DATE.

Sample Hardship Verbiage

January 1, 2016

Dear Lender:

I was recently laid off from work and have not been able to find another job. My husband works on

commission and his income was cut in half last year. We tried to work with you to modify our loan for

a lower payment, but we cannot even pay that any more. We don’t have any money in savings or

any money to pay our loan. We are asking you to please help us by approving the sale of our home

as a short sale. We don’t want to file for bankruptcy and we don’t want to go through a foreclosure.

Thank you for your cooperation. This will really help us stop worrying and to get a fresh start with our

family.

Sincerely,

Suzy Q. Seller

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1