Reporting Agent Authorization Form

ADVERTISEMENT

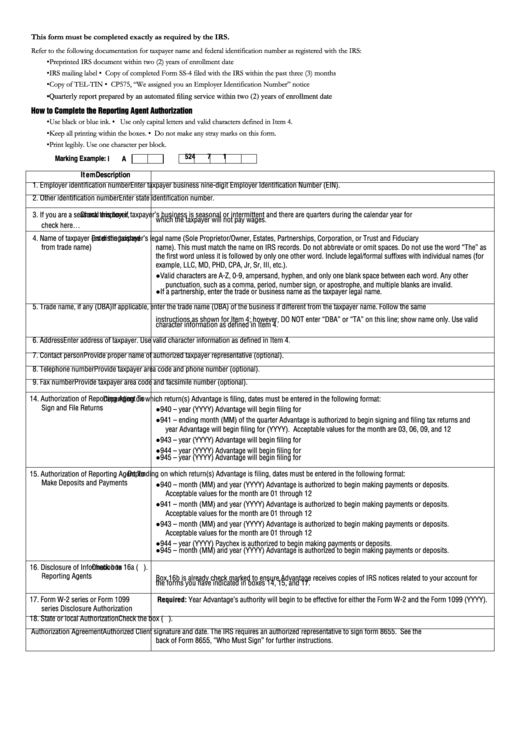

This form must be completed exactly as required by the IRS.

Refer to the following documentation for taxpayer name and federal identification number as registered with the IRS:

• Preprinted IRS document within two (2) years of enrollment date

• IRS mailing label

• Copy of completed Form SS-4 filed with the IRS within the past three (3) months

• Copy of TEL-TIN

• CP575, “We assigned you an Employer Identification Number” notice

• Quarterly report prepared by an automated filing service within two (2) years of enrollment date

How to Complete the Reporting Agent Authorization

• Use black or blue ink.

• Use only capital letters and valid characters defined in Item 4.

• Keep all printing within the boxes.

• Do not make any stray marks on this form.

• Print legibly. Use one character per block.

Marking Example:

I

A

5

2

4

7

1

It em

Description

1. Employer identification number

Enter taxpayer business nine-digit Employer Identification Number (EIN).

2. Other identification number

Enter state identification number.

3. If you are a seasonal employer,

Check this box if taxpayer’s business is seasonal or intermittent and there are quarters during the calendar year for

which the taxpayer will not pay wages.

check here…

4. Name of taxpayer (as distinguished

Enter the taxpayer’s legal name (Sole Proprietor/Owner, Estates, Partnerships, Corporation, or Trust and Fiduciary

from trade name)

name). This must match the name on IRS records. Do not abbreviate or omit spaces. Do not use the word “The” as

the first word unless it is followed by only one other word. Include legal/formal suffixes with individual names (for

example, LLC, MD, PHD, CPA, Jr, Sr, III, etc.).

● Valid characters are A-Z, 0-9, ampersand, hyphen, and only one blank space between each word. Any other

punctuation, such as a comma, period, number sign, or apostrophe, and multiple blanks are invalid.

● If a partnership, enter the trade or business name as the taxpayer legal name.

5. Trade name, if any (DBA)

If applicable, enter the trade name (DBA) of the business if different from the taxpayer name. Follow the same

instructions as shown for Item 4; however, DO NOT enter “DBA” or “TA” on this line; show name only. Use valid

character information as defined in Item 4.

6. Address

Enter address of taxpayer. Use valid character information as defined in Item 4.

7. Contact person

Provide proper name of authorized taxpayer representative (optional).

8. Telephone number

Provide taxpayer area code and phone number (optional).

9. Fax number

Provide taxpayer area code and facsimile number (optional).

14. Authorization of Reporting Agent To

Depending on which return(s) Advantage is filing, dates must be entered in the following format:

Sign and File Returns

● 940 – year (YYYY) Advantage will begin filing for

● 941 – ending month (MM) of the quarter Advantage is authorized to begin signing and filing tax returns and

year Advantage will begin filing for (YYYY). Acceptable values for the month are 03, 06, 09, and 12

● 943 – year (YYYY) Advantage will begin filing for

● 944 – year (YYYY) Advantage will begin filing for

● 945 – year (YYYY) Advantage will begin filing for

15. Authorization of Reporting Agent To

Depending on which return(s) Advantage is filing, dates must be entered in the following format:

Make Deposits and Payments

● 940 – month (MM) and year (YYYY) Advantage is authorized to begin making payments or deposits.

Acceptable values for the month are 01 through 12

● 941 – month (MM) and year (YYYY) Advantage is authorized to begin making payments or deposits.

Acceptable values for the month are 01 through 12

● 943 – month (MM) and year (YYYY) Advantage is authorized to begin making payments or deposits.

Acceptable values for the month are 01 through 12

● 944 – year (YYYY) Paychex is authorized to begin making payments or deposits.

● 945 – month (MM) and year (YYYY) Advantage is authorized to begin making payments or deposits.

16. Disclosure of Information to

Check box 16a ( ).

Reporting Agents

Box 16b is already check marked to ensure Advantage receives copies of IRS notices related to your account for

the forms you have indicated in boxes 14, 15, and 17.

17. Form W-2 series or Form 1099

Required: Year Advantage’s authority will begin to be effective for either the Form W-2 and the Form 1099 (YYYY).

series Disclosure Authorization

18. State or local Authorization

Check the box ( ).

Authorization Agreement

Authorized Client signature and date. The IRS requires an authorized representative to sign form 8655. See the

back of Form 8655, “Who Must Sign” for further instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3