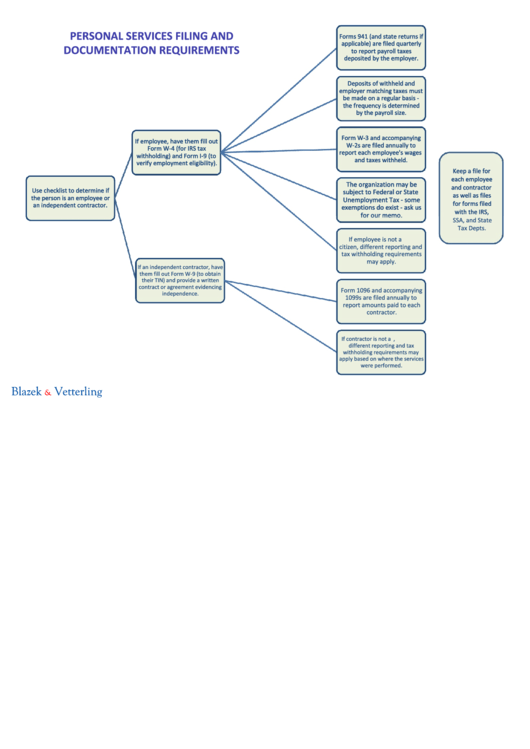

PERSONAL SERVICES FILING AND

Forms 941 (and state returns if

Forms 941 (and state returns if

applicable) are filed quarterly

applicable) are filed quarterly

DOCUMENTATION REQUIREMENTS

to report payroll taxes

to report payroll taxes

deposited by the employer.

deposited by the employer.

Deposits of withheld and

Deposits of withheld and

employer matching taxes must

employer matching taxes must

be made on a regular basis -

be made on a regular basis -

the frequency is determined

the frequency is determined

by the payroll size.

by the payroll size.

Form W-3 and accompanying

Form W-3 and accompanying

If employee, have them fill out

If employee, have them fill out

W-2s are filed annually to

W-2s are filed annually to

Form W-4 (for IRS tax

Form W-4 (for IRS tax

report each employee's wages

report each employee's wages

withholding) and Form I-9 (to

withholding) and Form I-9 (to

and taxes withheld.

and taxes withheld.

verify employment eligibility).

verify employment eligibility).

Keep a file for

Keep a file for

each employee

each employee

The organization may be

The organization may be

and contractor

and contractor

Use checklist to determine if

Use checklist to determine if

subject to Federal or State

subject to Federal or State

as well as files

as well as files

the person is an employee or

the person is an employee or

Unemployment Tax - some

Unemployment Tax - some

for forms filed

for forms filed

an independent contractor.

an independent contractor.

exemptions do exist - ask us

exemptions do exist - ask us

with the IRS,

with the IRS,

for our memo.

for our memo.

SSA, and State

Tax Depts.

If employee is not a U.S.

citizen, different reporting and

tax withholding requirements

may apply.

If an independent contractor, have

them fill out Form W-9 (to obtain

their TIN) and provide a written

contract or agreement evidencing

Form 1096 and accompanying

independence.

1099s are filed annually to

report amounts paid to each

contractor.

If contractor is not a U.S. citizen,

different reporting and tax

withholding requirements may

apply based on where the services

were performed.

Blazek

Vetterling

&

1

1 2

2 3

3