Required Minimum Distribution

ADVERTISEMENT

2012 Required Minimum Distribution

Mailing Address:

P.O. Box 8963

(RMD) Form

Wilmington, DE 19899-8963

800-209-9010 Fax: 302-999-9554

1. Tell Us About Yourself

(Please complete all fields below)

Name

Daytime Phone

Social Security Number

Account Number

Investment Firm/Account Executive’s Name

Investment Representative & Phone Number

Plan/Account Type:

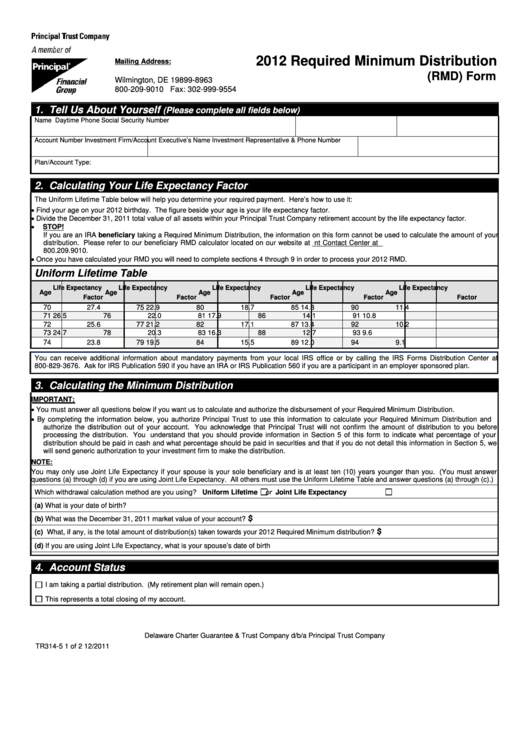

2. Calculating Your Life Expectancy Factor

The Uniform Lifetime Table below will help you determine your required payment. Here’s how to use it:

Find your age on your 2012 birthday. The figure beside your age is your life expectancy factor.

Divide the December 31, 2011 total value of all assets within your Principal Trust Company retirement account by the life expectancy factor.

STOP!

If you are an IRA beneficiary taking a Required Minimum Distribution, the information on this form cannot be used to calculate the amount of your

distribution. Please refer to our beneficiary RMD calculator located on our website at or call our Client Contact Center at

800.209.9010.

Once you have calculated your RMD you will need to complete sections 4 through 9 in order to process your 2012 RMD.

Uniform Lifetime Table

Life Expectancy

Life Expectancy

Life Expectancy

Life Expectancy

Life Expectancy

Age

Age

Age

Age

Age

Factor

Factor

Factor

Factor

Factor

70

27.4

75

22.9

80

18.7

85

14.8

90

11.4

71

26.5

76

22.0

81

17.9

86

14.1

91

10.8

72

25.6

77

21.2

82

17.1

87

13.4

92

10.2

73

24.7

78

20.3

83

16.3

88

12.7

93

9.6

74

23.8

79

19.5

84

15.5

89

12.0

94

9.1

You can receive additional information about mandatory payments from your local IRS office or by calling the IRS Forms Distribution Center at

800-829-3676. Ask for IRS Publication 590 if you have an IRA or IRS Publication 560 if you are a participant in an employer sponsored plan.

3. Calculating the Minimum Distribution

IMPORTANT:

You must answer all questions below if you want us to calculate and authorize the disbursement of your Required Minimum Distribution.

By completing the information below, you authorize Principal Trust to use this information to calculate your Required Minimum Distribution and

authorize the distribution out of your account. You acknowledge that Principal Trust will not confirm the amount of distribution to you before

processing the distribution. You understand that you should provide information in Section 5 of this form to indicate what percentage of your

distribution should be paid in cash and what percentage should be paid in securities and that if you do not detail this information in Section 5, we

will send generic authorization to your investment firm to make the distribution.

NOTE:

You may only use Joint Life Expectancy if your spouse is your sole beneficiary and is at least ten (10) years younger than you. (You must answer

questions (a) through (d) if you are using Joint Life Expectancy. All others must use the Uniform Lifetime Table and answer questions (a) through (c).)

Which withdrawal calculation method are you using?

Uniform Lifetime

or

Joint Life Expectancy

(a) What is your date of birth?

$

(b) What was the December 31, 2011 market value of your account?

$

(c) What, if any, is the total amount of distribution(s) taken towards your 2012 Required Minimum distribution?

(d) If you are using Joint Life Expectancy, what is your spouse’s date of birth

4. Account Status

I am taking a partial distribution. (My retirement plan will remain open.)

This represents a total closing of my account.

Delaware Charter Guarantee & Trust Company d/b/a Principal Trust Company

TR314-5

1 of 2

12/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2