Print

Reset

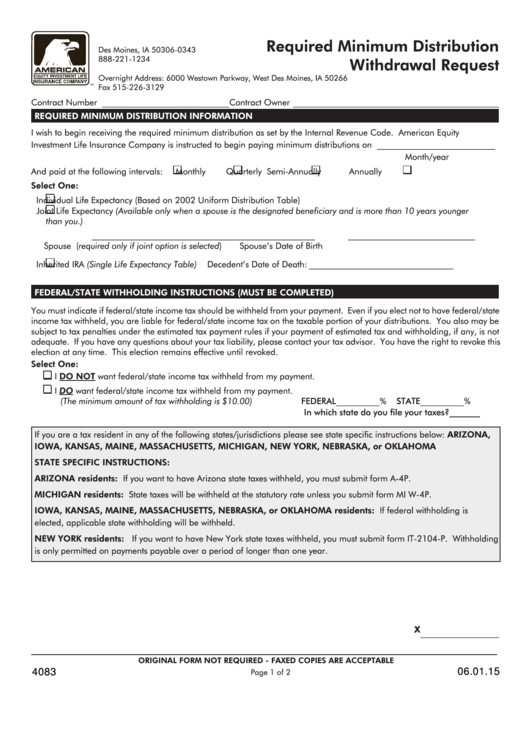

P .O. Box 10343

Required Minimum Distribution

Des Moines, IA 50306-0343

888-221-1234

Withdrawal Request

Overnight Address: 6000 Westown Parkway, West Des Moines, IA 50266

Fax 515-226-3129

Contract Number _____________________________ Contract Owner _______________________________________________

REQUIRED MINIMUM DISTRIBUTION INFORMATION

I wish to begin receiving the required minimum distribution as set by the Internal Revenue Code. American Equity

Investment Life Insurance Company is instructed to begin paying minimum distributions on ___________________________

Month/year

And paid at the following intervals:

Monthly

Quarterly

Semi-Annually

Annually

Select One:

Individual Life Expectancy (Based on 2002 Uniform Distribution Table)

Joint Life Expectancy (Available only when a spouse is the designated beneficiary and is more than 10 years younger

than you.)

___________________________________________________

_____________________________

Spouse (required only if joint option is selected)

Spouse’s Date of Birth

Inherited IRA (Single Life Expectancy Table)

Decedent’s Date of Death: _________________________________

FEDERAL/STATE WITHHOLDING INSTRUCTIONS (MUST BE COMPLETED)

You must indicate if federal/state income tax should be withheld from your payment. Even if you elect not to have federal/state

income tax withheld, you are liable for federal/state income tax on the taxable portion of your distributions. You also may be

subject to tax penalties under the estimated tax payment rules if your payment of estimated tax and withholding, if any, is not

adequate. If you have any questions about your tax liability, please contact your tax advisor. You have the right to revoke this

election at any time. This election remains effective until revoked.

Select One:

I DO NOT want federal/state income tax withheld from my payment.

I DO want federal/state income tax withheld from my payment.

(The minimum amount of tax withholding is $10.00)

FEDERAL__________%

STATE__________%

In which state do you file your taxes?_______

If you are a tax resident in any of the following states/jurisdictions please see state specific instructions below: ARIZONA,

IOWA, KANSAS, MAINE, MASSACHUSETTS, MICHIGAN, NEW YORK, NEBRASKA, or OKLAHOMA

STATE SPECIFIC INSTRUCTIONS:

ARIZONA residents: If you want to have Arizona state taxes withheld, you must submit form A-4P .

MICHIGAN residents: State taxes will be withheld at the statutory rate unless you submit form MI W-4P .

IOWA, KANSAS, MAINE, MASSACHUSETTS, NEBRASKA, or OKLAHOMA residents: If federal withholding is

elected, applicable state withholding will be withheld.

NEW YORK residents: If you want to have New York state taxes withheld, you must submit form IT-2104-P . Withholding

is only permitted on payments payable over a period of longer than one year.

X __________________

Owner’s Initials

ORIGINAL FORM NOT REQUIRED - FAXED COPIES ARE ACCEPTABLE

4083

06.01.15

Page 1 of 2

1

1 2

2