Voya Simple Ira Required Minimum Distribution Election Form - 2011

ADVERTISEMENT

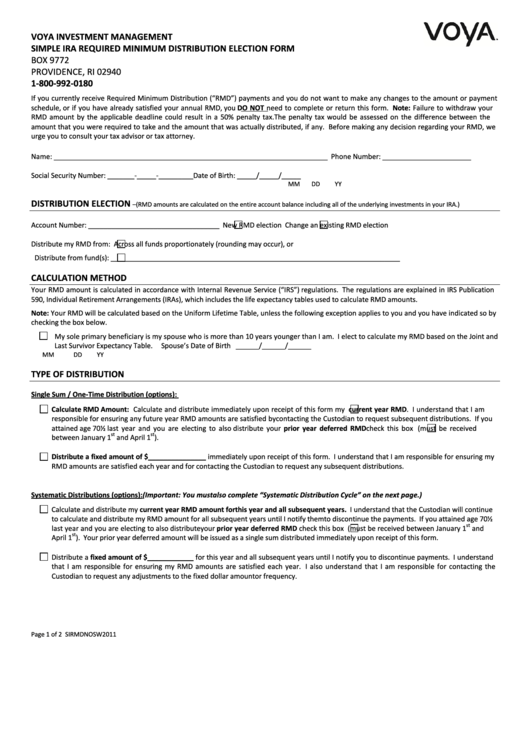

VOYA INVESTMENT MANAGEMENT

SIMPLE IRA REQUIRED MINIMUM DISTRIBUTION ELECTION FORM

P.O. BOX 9772

PROVIDENCE, RI 02940

1-800-992-0180

If you currently receive Required Minimum Distribution (“RMD”) payments and you do not want to make any changes to the amount or payment

schedule, or if you have already satisfied your annual RMD, you DO NOT need to complete or return this form. Note: Failure to withdraw your

RMD amount by the applicable deadline could result in a 50% penalty tax. The penalty tax would be assessed on the difference between the

amount that you were required to take and the amount that was actually distributed, if any. Before making any decision regarding your RMD, we

urge you to consult your tax advisor or tax attorney.

Name: _______________________________________________________________________ Phone Number: _______________________

Social Security Number: _______-_____-_________

Date of Birth: _____/_____/_____

MM

DD

YY

DISTRIBUTION ELECTION

– (RMD amounts are calculated on the entire account balance including all of the underlying investments in your IRA.)

Account Number: __________________________________

New RMD election

Change an existing RMD election

Distribute my RMD from:

Across all funds proportionately (rounding may occur), or

Distribute from fund(s): ___________________________________________________________________________

CALCULATION METHOD

Your RMD amount is calculated in accordance with Internal Revenue Service (“IRS”) regulations. The regulations are explained in IRS Publication

590, Individual Retirement Arrangements (IRAs), which includes the life expectancy tables used to calculate RMD amounts.

Note: Your RMD will be calculated based on the Uniform Lifetime Table, unless the following exception applies to you and you have indicated so by

checking the box below.

My sole primary beneficiary is my spouse who is more than 10 years younger than I am. I elect to calculate my RMD based on the Joint and

Last Survivor Expectancy Table.

Spouse’s Date of Birth ______/______/______

MM

DD

YY

TYPE OF DISTRIBUTION

Single Sum / One-Time Distribution (options):

Calculate RMD Amount: Calculate and distribute immediately upon receipt of this form my

current year RMD. I understand that I am

responsible for ensuring any future year RMD amounts are satisfied by contacting the Custodian to request subsequent distributions. If you

attained age 70½ last year and you are electing to also distribute your prior year deferred RMD check this box

(must be received

st

st

between January 1

and April 1

).

Distribute a fixed amount of $_______________ immediately upon receipt of this form. I understand that I am responsible for ensuring my

RMD amounts are satisfied each year and for contacting the Custodian to request any subsequent distributions.

Systematic Distributions (options): (Important: You must also complete “Systematic Distribution Cycle” on the next page.)

Calculate and distribute my current year RMD amount for this year and all subsequent years. I understand that the Custodian will continue

to calculate and distribute my RMD amount for all subsequent years until I notify them to discontinue the payments. If you attained age 70½

st

last year and you are electing to also distribute your prior year deferred RMD check this box

(must be received between January 1

and

st

April 1

). Your prior year deferred amount will be issued as a single sum distributed immediately upon receipt of this form.

Distribute a fixed amount of $____________ for this year and all subsequent years until I notify you to discontinue payments. I understand

that I am responsible for ensuring my RMD amounts are satisfied each year. I also understand that I am responsible for contacting the

Custodian to request any adjustments to the fixed dollar amount or frequency.

Page 1 of 2

SIRMDNOSW2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2