Clear

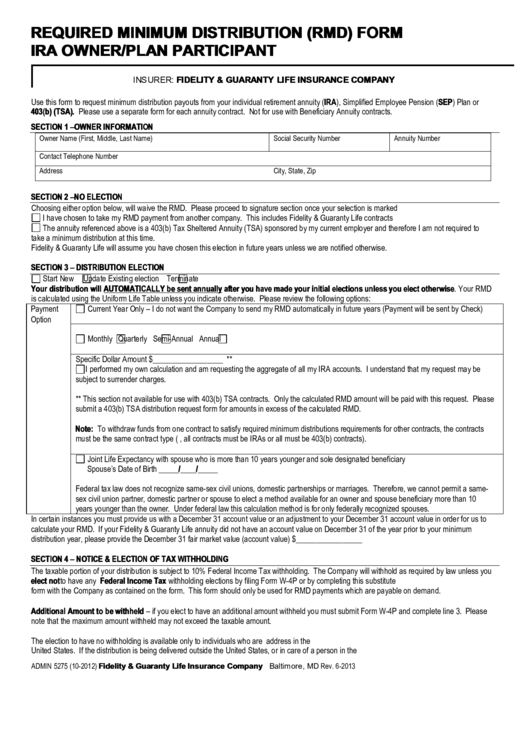

REQUIRED MINIMUM DISTRIBUTION (RMD) FORM

IRA OWNER/PLAN PARTICIPANT

INSURER: FIDELITY & GUARANTY LIFE INSURANCE COMPANY

Use this form to request minimum distribution payouts from your individual retirement annuity (IRA), Simplified Employee Pension (SEP) Plan or

403(b) (TSA). Please use a separate form for each annuity contract. Not for use with Beneficiary Annuity contracts.

SECTION 1 –OWNER INFORMATION

Owner Name (First, Middle, Last Name)

Social Security Number

Annuity Number

Contact Telephone Number

Address

City, State, Zip

SECTION 2 –NO ELECTION

Choosing either option below, will waive the RMD. Please proceed to signature section once your selection is marked

I have chosen to take my RMD payment from another company. This includes Fidelity & Guaranty Life contracts

The annuity referenced above is a 403(b) Tax Sheltered Annuity (TSA) sponsored by my current employer and therefore I am not required to

take a minimum distribution at this time.

Fidelity & Guaranty Life will assume you have chosen this election in future years unless we are notified otherwise.

SECTION 3 – DISTRIBUTION ELECTION

Start New

Update Existing election

Terminate

Your distribution will AUTOMATICALLY be sent annually after you have made your initial elections unless you elect otherwise. Your RMD

is calculated using the Uniform Life Table unless you indicate otherwise. Please review the following options:

Payment

Current Year Only – I do not want the Company to send my RMD automatically in future years (Payment will be sent by Check)

Option

Monthly

Quarterly

Semi-Annual

Annual

Specific Dollar Amount $__________________ **

I performed my own calculation and am requesting the aggregate of all my IRA accounts. I understand that my request may be

subject to surrender charges.

** This section not available for use with 403(b) TSA contracts. Only the calculated RMD amount will be paid with this request. Please

submit a 403(b) TSA distribution request form for amounts in excess of the calculated RMD.

Note: To withdraw funds from one contract to satisfy required minimum distributions requirements for other contracts, the contracts

must be the same contract type (e.g., all contracts must be IRAs or all must be 403(b) contracts).

Joint Life Expectancy with spouse who is more than 10 years younger and sole designated beneficiary

Spouse’s Date of Birth _____/____/_____

Federal tax law does not recognize same-sex civil unions, domestic partnerships or marriages. Therefore, we cannot permit a same-

sex civil union partner, domestic partner or spouse to elect a method available for an owner and spouse beneficiary more than 10

years younger than the owner. Under federal law this calculation method is for only federally recognized spouses.

In certain instances you must provide us with a December 31 account value or an adjustment to your December 31 account value in order for us to

calculate your RMD. If your Fidelity & Guaranty Life annuity did not have an account value on December 31 of the year prior to your minimum

distribution year, please provide the December 31 fair market value (account value) $_________________

SECTION 4 – NOTICE & ELECTION OF TAX WITHHOLDING

The taxable portion of your distribution is subject to 10% Federal Income Tax withholding. The Company will withhold as required by law unless you

elect not to have any withholding. You can make Federal Income Tax withholding elections by filing Form W-4P or by completing this substitute

form with the Company as contained on the form. This form should only be used for RMD payments which are payable on demand.

Additional Amount to be withheld – if you elect to have an additional amount withheld you must submit Form W-4P and complete line 3. Please

note that the maximum amount withheld may not exceed the taxable amount.

The election to have no withholding is available only to individuals who are U.S. Citizens or resident aliens and have a residential address in the

United States. If the distribution is being delivered outside the United States, or in care of a person in the U.S. withholding requirements apply.

ADMIN 5275 (10-2012)

Rev. 6-2013

Fidelity & Guaranty Life Insurance Company Baltimore, MD

1

1 2

2 3

3