Mha Screening Checklist

Download a blank fillable Mha Screening Checklist in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Mha Screening Checklist with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Name or Client Number: _____________________________________________

Date: ____________________

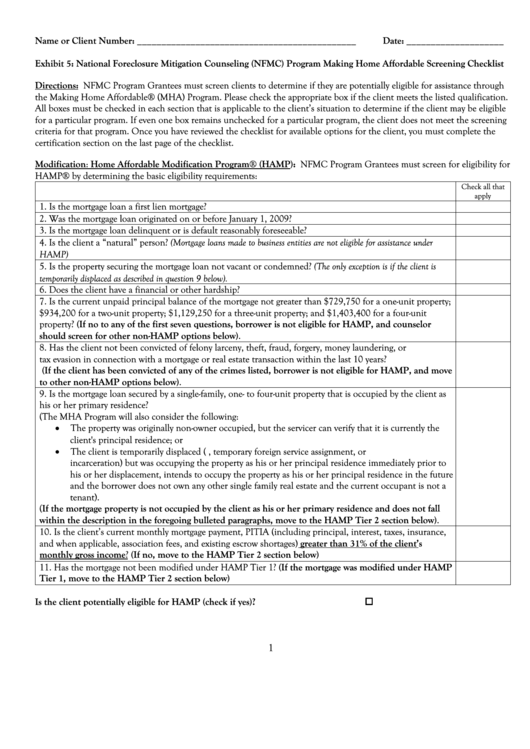

Exhibit 5: National Foreclosure Mitigation Counseling (NFMC) Program Making Home Affordable Screening Checklist

Directions: NFMC Program Grantees must screen clients to determine if they are potentially eligible for assistance through

the Making Home Affordable® (MHA) Program. Please check the appropriate box if the client meets the listed qualification.

All boxes must be checked in each section that is applicable to the client’s situation to determine if the client may be eligible

for a particular program. If even one box remains unchecked for a particular program, the client does not meet the screening

criteria for that program. Once you have reviewed the checklist for available options for the client, you must complete the

certification section on the last page of the checklist.

Modification: Home Affordable Modification Program® (HAMP): NFMC Program Grantees must screen for eligibility for

HAMP® by determining the basic eligibility requirements:

Check all that

apply

1. Is the mortgage loan a first lien mortgage?

2. Was the mortgage loan originated on or before January 1, 2009?

3. Is the mortgage loan delinquent or is default reasonably foreseeable?

4. Is the client a “natural” person? (Mortgage loans made to business entities are not eligible for assistance under

HAMP)

5. Is the property securing the mortgage loan not vacant or condemned? (The only exception is if the client is

temporarily displaced as described in question 9 below).

6. Does the client have a financial or other hardship?

7. Is the current unpaid principal balance of the mortgage not greater than $729,750 for a one-unit property;

$934,200 for a two-unit property; $1,129,250 for a three-unit property; and $1,403,400 for a four-unit

property? (If no to any of the first seven questions, borrower is not eligible for HAMP, and counselor

should screen for other non-HAMP options below).

8. Has the client not been convicted of felony larceny, theft, fraud, forgery, money laundering, or

tax evasion in connection with a mortgage or real estate transaction within the last 10 years?

(If the client has been convicted of any of the crimes listed, borrower is not eligible for HAMP, and move

to other non-HAMP options below).

9. Is the mortgage loan secured by a single-family, one- to four-unit property that is occupied by the client as

his or her primary residence?

(The MHA Program will also consider the following:

The property was originally non-owner occupied, but the servicer can verify that it is currently the

client's principal residence; or

The client is temporarily displaced (e.g. military service, temporary foreign service assignment, or

incarceration) but was occupying the property as his or her principal residence immediately prior to

his or her displacement, intends to occupy the property as his or her principal residence in the future

and the borrower does not own any other single family real estate and the current occupant is not a

tenant).

(If the mortgage property is not occupied by the client as his or her primary residence and does not fall

within the description in the foregoing bulleted paragraphs, move to the HAMP Tier 2 section below).

10. Is the client’s current monthly mortgage payment, PITIA (including principal, interest, taxes, insurance,

and when applicable, association fees, and existing escrow shortages) greater than 31% of the client’s

monthly gross income? (If no, move to the HAMP Tier 2 section below)

11. Has the mortgage not been modified under HAMP Tier 1? (If the mortgage was modified under HAMP

Tier 1, move to the HAMP Tier 2 section below)

Is the client potentially eligible for HAMP (check if yes)?

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Medical

1

1 2

2 3

3