Mha Screening Checklist Page 2

Download a blank fillable Mha Screening Checklist in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Mha Screening Checklist with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

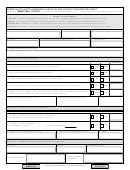

Modification: Home Affordable Modification Program Tier 2 (HAMP Tier 2): Please note, pursuant to NFMC

guidelines, NFMC funds can only be used for single-family, owner-occupied, one-to-four unit properties. NFMC Program

Grantees must screen clients for HAMP Tier 2, if applicable, by determining the following:

Check all that

apply

1. Does the client meet the screening qualifications for HAMP listed in questions 1-8 (see pg.1)?

2. Is the mortgage loan secured by a single-family property that is owner-occupied, or used for rental purposes

by the client, whether as a principal residence, second home, or vacation home?

(Please note: For Tier 2, the property must be owner occupied or a rental property. A rental property that is used by the

borrower for rental purposes only and not occupied by the borrower, whether as a principal residence, second home,

vacation home or otherwise. A mortgage may be considered for Tier 2 if the property is (1) occupied by a tenant as a

principal residence, (2) occupied by the borrower’s legal dependent, parent or grandparent as his principal residence

without rent being charged, or (3) vacant and available for rent).

3. Has the client’s mortgage been previously modified under HAMP, or received a Trial Period Plan (TPP), of

which, they defaulted?

(Please note: For Tier 2, a modification may be granted if: (1) the loan has not received a permanent modification or

TPP under Tier 2; (2) for a loan that received a Tier 1 modification and lost good standing, 12 months have passed since

the Tier 1 modification effective date, or the borrower has experienced a change of circumstances; (3) the loan received a

Tier 1 TPP but the borrower defaulted).

Note: Under HAMP, a borrower or co-borrower may receive permanent HAMP modifications on mortgages secured by up to six properties, HAMP Tier 1 or Tier 2 on the

loan secured by the owner-occupied property, and five Tier 2 permanent modifications on mortgages meeting the Tier 2 eligibility requirements.

Is the client potentially eligible for HAMP Tier 2 (check if yes)?

Refinance: Home Affordable Refinance Program (HARP): Please note, pursuant to NFMC guidelines, NFMC funds can

only be used for single-family, owner-occupied, one-to-four unit properties. NFMC Program Grantees must screen for

HARP by determining the following:

Check all that

apply

1. Does Freddie Mac or Fannie Mae own or guarantee your loan?

(Please note: Information is available through loan look-up tools at Fannie Mae and Freddie Mac's websites:

Fannie Mae - https://

Freddie Mac -

)

2. Was the loan purchased by Freddie Mac or Fannie Mae on or before May 31, 2009?

(Please note: Information is available through loan look-up tools at Fannie Mae and Freddie Mac's websites:

Fannie Mae - https://

Freddie Mac - )

3. Is the loan-to-value greater than 80%?

4. Is the mortgage current, with no 30-day late payments in the last six months and no more than one in the

past 12 months?

5. Would a refinance improve the long-term affordability or stability of the loan?

Is the client potentially eligible for HARP (check if yes)?

FHA-HAMP: NFMC Program Grantees must screen for eligibility for FHA-HAMP by determining the following:

Check all that

apply

1. Does the client have a loan that is insured or guaranteed by the Federal Housing Administration?

2. Has the client experienced a loss of income or increase in living expenses?

3. Is either the applicant or co-applicant on the mortgage employed?

4. Has the client not received a stand-alone Loan Modification or FHA-HAMP in the previous 24 months?

5. The client’s surplus income is not greater than 15% of his or her net monthly income, and $300?

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Medical

1

1 2

2 3

3