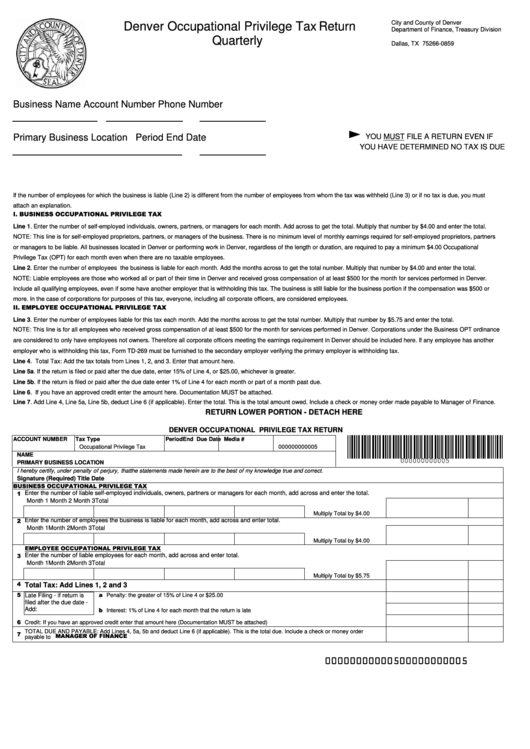

City and County of Denver

Denver Occupational Privilege Tax Return

Department of Finance, Treasury Division

P.O. Box 660859

Quarterly

Dallas, TX 75266-0859

Business Name

Account Number

Phone Number

YOU MUST FILE A RETURN EVEN IF

Primary Business Location

Period End Date

YOU HAVE DETERMINED NO TAX IS DUE

If the number of employees for which the business is liable (Line 2) is different from the number of employees from whom the tax was withheld (Line 3) or if no tax is due, you must

attach an explanation.

I. BUSINESS OCCUPATIONAL PRIVILEGE TAX

Line 1. Enter the number of self-employed individuals, owners, partners, or managers for each month. Add across to get the total. Multiply that number by $4.00 and enter the total.

NOTE: This line is for self-employed proprietors, partners, or managers of the business. There is no minimum level of monthly earnings required for self-employed proprietors, partners

or managers to be liable. All businesses located in Denver or performing work in Denver, regardless of the length or duration, are required to pay a minimum $4.00 Occupational

Privilege Tax (OPT) for each month even when there are no taxable employees.

Line 2. Enter the number of employees the business is liable for each month. Add the months across to get the total number. Multiply that number by $4.00 and enter the total.

NOTE: Liable employees are those who worked all or part of their time in Denver and received gross compensation of at least $500 for the month for services performed in Denver.

Include all qualifying employees, even if some have another employer that is withholding this tax. The business is still liable for the business portion if the compensation was $500 or

more. In the case of corporations for purposes of this tax, everyone, including all corporate officers, are considered employees.

II. EMPLOYEE OCCUPATIONAL PRIVILEGE TAX

Line 3. Enter the number of employees liable for this tax each month. Add the months across to get the total number. Multiply that number by $5.75 and enter the total.

NOTE: This line is for all employees who received gross compensation of at least $500 for the month for services performed in Denver. Corporations under the Business OPT ordinance

are considered to only have employees not owners. Therefore all corporate officers meeting the earnings requirement in Denver should be included here. If any employee has another

employer who is withholding this tax, Form TD-269 must be furnished to the secondary employer verifying the primary employer is withholding tax.

Line 4. Total Tax: Add the tax totals from Lines 1, 2, and 3. Enter that amount here.

Line 5a. If the return is filed or paid after the due date, enter 15% of Line 4, or $25.00, whichever is greater.

Line 5b. If the return is filed or paid after the due date enter 1% of Line 4 for each month or part of a month past due.

Line 6. If you have an approved credit enter the amount here. Documentation MUST be attached.

Line 7. Add Line 4, Line 5a, Line 5b, deduct Line 6 (if applicable). Enter the total. This is the total amount owed. Include a check or money order made payable to Manager of Finance.

RETURN LOWER PORTION - DETACH HERE

DENVER OCCUPATIONAL PRIVILEGE TAX RETURN

ACCOUNT NUMBER

Tax Type

Period End

Due Date

Media #

000000000005

Occupational Privilege Tax

NAME

000000000005

PRIMARY BUSINESS LOCATION

I hereby certify, under penalty of perjury, that the statements made herein are to the best of my knowledge true and correct.

Signature (Required)

Title

Date

BUSINESS OCCUPATIONAL PRIVILEGE TAX

1

Enter the number of liable self-employed individuals, owners, partners or managers for each month, add across and enter the total.

Month 1

Month 2

Month 3

Total

Multiply Total by $4.00

2

Enter the number of employees the business is liable for each month, add across and enter total.

Month 1

Month 2

Month 3

Total

Multiply Total by $4.00

EMPLOYEE OCCUPATIONAL PRIVILEGE TAX

3

Enter the number of liable employees for each month, add across and enter total.

Month 1

Month 2

Month 3

Total

Multiply Total by $5.75

4

Total Tax: Add Lines 1, 2 and 3

5

a Penalty: the greater of 15% of Line 4 or $25.00

Late Filing - if return is

filed after the due date -

b Interest: 1% of Line 4 for each month that the return is late

Add:

6 Credit: If you have an approved credit enter that amount here (Documentation MUST be attached)

TOTAL DUE AND PAYABLE: Add Lines 4, 5a, 5b and deduct Line 6 (if applicable). This is the total due. Include a check or money order

7

payable to MANAGER OF FINANCE

00000000000500000000005

1

1