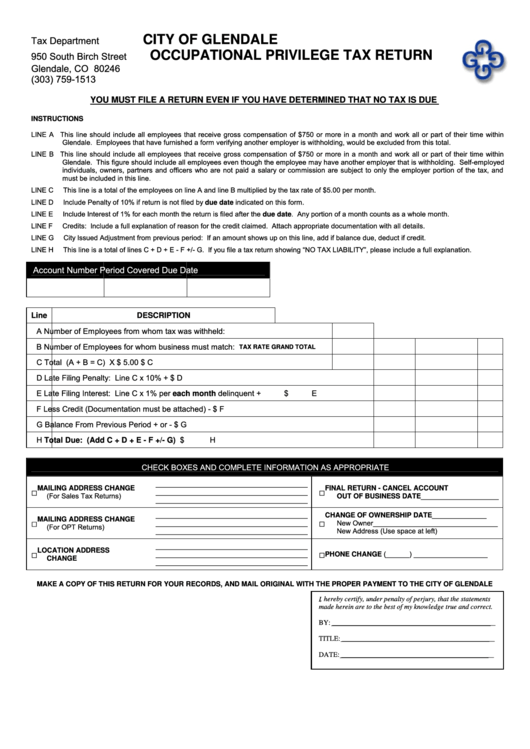

City Of Glendale 950 South Birch Street Occupational Privilege Tax Return Form

ADVERTISEMENT

CITY OF GLENDALE

Tax Department

OCCUPATIONAL PRIVILEGE TAX RETURN

950 South Birch Street

Glendale, CO 80246

(303) 759-1513

YOU MUST FILE A RETURN EVEN IF YOU HAVE DETERMINED THAT NO TAX IS DUE

INSTRUCTIONS

LINE A

This line should include all employees that receive gross compensation of $750 or more in a month and work all or part of their time within

Glendale. Employees that have furnished a form verifying another employer is withholding, would be excluded from this total.

LINE B

This line should include all employees that receive gross compensation of $750 or more in a month and work all or part of their time within

Glendale. This figure should include all employees even though the employee may have another employer that is withholding. Self-employed

individuals, owners, partners and officers who are not paid a salary or commission are subject to only the employer portion of the tax, and

must be included in this line.

LINE C

This line is a total of the employees on line A and line B multiplied by the tax rate of $5.00 per month.

LINE D

Include Penalty of 10% if return is not filed by due date indicated on this form.

LINE E

Include Interest of 1% for each month the return is filed after the due date. Any portion of a month counts as a whole month.

LINE F

Credits: Include a full explanation of reason for the credit claimed. Attach appropriate documentation with all details.

LINE G

City Issued Adjustment from previous period: If an amount shows up on this line, add if balance due, deduct if credit.

LINE H

This line is a total of lines C + D + E - F +/- G. If you file a tax return showing “NO TAX LIABILITY”, please include a full explanation.

Account Number

Period Covered

Due Date

Line

DESCRIPTION

A

Number of Employees from whom tax was withheld:

B

Number of Employees for whom business must match:

TAX RATE

GRAND TOTAL

C

Total (A + B = C)

X $ 5.00

$

C

D

Late Filing Penalty: Line C x 10%

+

$

D

E

Late Filing Interest: Line C x 1% per each month delinquent

+

$

E

F

Less Credit (Documentation must be attached)

-

$

F

G

Balance From Previous Period

+ or -

$

G

H

$

H

Total Due: (Add C + D + E - F +/- G)

CHECK BOXES AND COMPLETE INFORMATION AS APPROPRIATE

_______________________________________

MAILING ADDRESS CHANGE

FINAL RETURN - CANCEL ACCOUNT

□

□

_______________________________________

(For Sales Tax Returns)

OUT OF BUSINESS DATE____________________

_______________________________________

_______________________________________

CHANGE OF OWNERSHIP DATE______________

MAILING ADDRESS CHANGE

□

□

_______________________________________

New Owner________________________________

(For OPT Returns)

_______________________________________

New Address (Use space at left)

_______________________________________

LOCATION ADDRESS

□

□

_______________________________________

PHONE CHANGE (______) ___________________

CHANGE

_______________________________________

MAKE A COPY OF THIS RETURN FOR YOUR RECORDS, AND MAIL ORIGINAL WITH THE PROPER PAYMENT TO THE CITY OF GLENDALE

I, hereby certify, under penalty of perjury, that the statements

made herein are to the best of my knowledge true and correct.

BY: ______________________________________________

TITLE: ___________________________________________

DATE: ___________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2