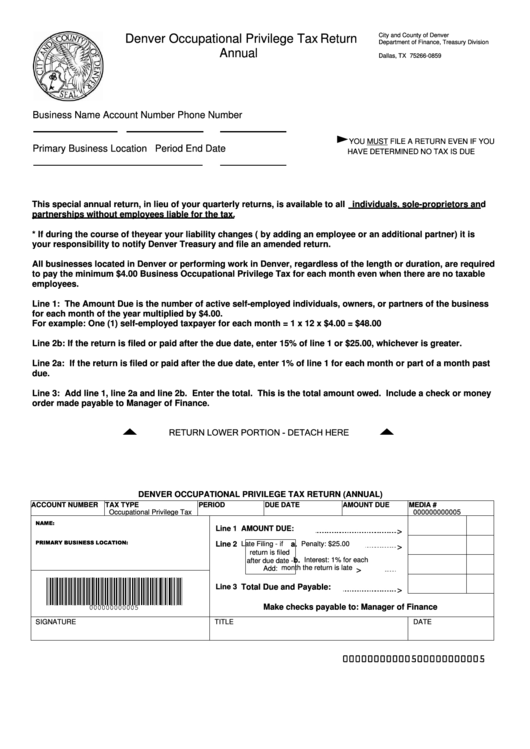

City and County of Denver

Denver Occupational Privilege Tax Return

Department of Finance, Treasury Division

P.O. Box 660859

Annual

Dallas, TX 75266-0859

Business Name

Account Number

Phone Number

YOU MUST FILE A RETURN EVEN IF YOU

Primary Business Location

Period End Date

HAVE DETERMINED NO TAX IS DUE

This special annual return, in lieu of your quarterly returns, is available to all individuals, sole-proprietors and

partnerships without employees liable for the tax.

* If during the course of the year your liability changes (e.g. by adding an employee or an additional partner) it is

your responsibility to notify Denver Treasury and file an amended return.

All businesses located in Denver or performing work in Denver, regardless of the length or duration, are required

to pay the minimum $4.00 Business Occupational Privilege Tax for each month even when there are no taxable

employees.

Line 1: The Amount Due is the number of active self-employed individuals, owners, or partners of the business

for each month of the year multiplied by $4.00.

For example: One (1) self-employed taxpayer for each month = 1 x 12 x $4.00 = $48.00

Line 2b: If the return is filed or paid after the due date, enter 15% of line 1 or $25.00, whichever is greater.

Line 2a: If the return is filed or paid after the due date, enter 1% of line 1 for each month or part of a month past

due.

Line 3: Add line 1, line 2a and line 2b. Enter the total. This is the total amount owed. Include a check or money

order made payable to Manager of Finance.

RETURN LOWER PORTION - DETACH HERE

DENVER OCCUPATIONAL PRIVILEGE TAX RETURN (ANNUAL)

ACCOUNT NUMBER TAX TYPE

PERIOD

DUE DATE

AMOUNT DUE

MEDIA #

Occupational Privilege Tax

000000000005

NAME:

Line 1

AMOUNT DUE:

>

PRIMARY BUSINESS LOCATION:

Line 2

Late Filing - if

a.

Penalty: $25.00

>

return is filed

b.

Interest: 1% for each

after due date -

month the return is late

Add:

>

Line 3

Total Due and Payable:

>

000000000005

Make checks payable to: Manager of Finance

SIGNATURE

TITLE

DATE

00000000000500000000005

1

1