INSTRUCTIONS

Prepare a separate document for either a Lump Sum Payment or a Compensatory Time Payment.

Do not complete blocks 7 through 12 for a Compensatory Time Payment.

BLOCK 1. Enter employee’s social security number.

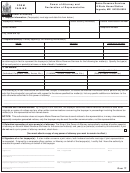

BLOCK 24. Enter “0” if accounting data is furnished in

block 25. Enter “1” if accounting data in em-

BLOCK 2. Enter employee’s last name, first name, and

ployee’s data base record is to be used.

middle initial.

BLOCK 25. Enter accounting data codes to which the

BLOCK 3. Enter the two-digit agency code for the agen-

payment is being charged and the number of

cy charged with the payment.

hours charged to each code. Leave blank if

BLOCK 4. Enter the separation date, if applicable.

“1” is entered in block 24.

BLOCK 5. Enter applicable code. Only one block should

BLOCK 26. Enter the total amount of line items comple-

contain an entry.

ted in block 25.

BLOCK 6. Enter “0” if the payment will be taxed accor-

BLOCK 27. Enter any information pertinent to the pay-

ding to the tax code in the employee’s payroll

ment which is not furnished elsewhere on the

master. Enter “1” if the 20% tax is to be ap-

form.

plied to the payment.

BLOCK 28. Enter the four-digit employing office code.

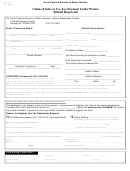

BLOCK 7. Enter “0” if there is no advance sick leave to

BLOCK 29. Enter the date the employee was rehired, if

be forgiven. Enter “1” if the employee has

previously separated.

advance sick leave to be forgiven.

BLOCK 30. Enter the T&A contact point.

BLOCK 8. Enter “0” if there is no COLA to be paid. If

there is a COLA amount due the employee,

BLOCK 31. Enter daily hours for employee’s established

enter “1”.

tour of duty.

BLOCK 9. Enter “0” if there is no Administrative Uncon-

BLOCK 32A.

Enter amount of leave brought forward,

trollable Overtime (AUO) to be paid.

Enter

earned, used, and balance or total on

“1” if AUO is due.

hand for each type leave (restored an-

nual, annual, sick, AWOP, and comp).

BLOCK 10. When the payment to be made is based on

Enter the rate used to compute comp

wage shift rates, enter the number of hours

time.

under the appropriate rate column. Fractions

B.

Enter leave year being audited.

of any hour may be entered an “½”, “ r ”,

C.

Enter employee’s leave category.

etc.

D.

Enter employee’s service computation

BLOCK 11. Enter the projected date through which the

date.

lump sum payment carries for A—annual

E.

Enter date employee entered on duty on-

leave restored; B—annual leave within cei-

ly if date is in year of audit.

ling; and C—annual leave above ceiling.

BLOCK 33. Enter signature and title of agency offical au-

BLOCK 12. Enter the hours applicable to the last day of

thorized to approve payment, and the date

the lump sum payment.

the form is prepared.

BLOCK 13. Enter the total hours to be paid.

1

1 2

2