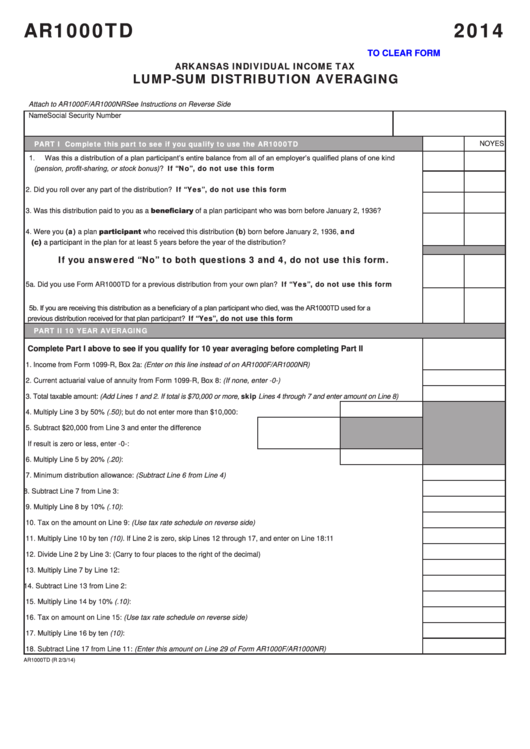

AR1000TD

2014

CLICK HERE TO CLEAR FORM

ARKANSAS INDIVIDUAL INCOME TAX

LUMP-SUM DISTRIBUTION AVERAGING

Attach to AR1000F/AR1000NR

See Instructions on Reverse Side

Name

Social Security Number

PART I

Complete this part to see if you qualify to use the AR1000TD

YES

NO

1.

Was this a distribution of a plan participant’s entire balance from all of an employer’s qualified plans of one kind

(pension, profit-sharing, or stock bonus)? If “No”, do not use this form .................................................................1

Did you roll over any part of the distribution? If “Yes”, do not use this form...........................................................2

2.

Was this distribution paid to you as a beneficiary of a plan participant who was born before January 2, 1936? ...........3

3.

Were you (a) a plan participant who received this distribution (b) born before January 2, 1936, and

4.

(c) a participant in the plan for at least 5 years before the year of the distribution? ..........................................................4

If you answered “No” to both questions 3 and 4, do not use this form.

5a. Did you use Form AR1000TD for a previous distribution from your own plan? If “Yes”, do not use this form .......5A

5b. If you are receiving this distribution as a beneficiary of a plan participant who died, was the AR1000TD used for a

previous distribution received for that plan participant? If “Yes”, do not use this form ....................................................5B

PART II

10 YEAR AVERAGING

Complete Part I above to see if you qualify for 10 year averaging before completing Part II

1.

Income from Form 1099-R, Box 2a: (Enter on this line instead of on AR1000F/AR1000NR) ..................................................1

2.

Current actuarial value of annuity from Form 1099-R, Box 8: (If none, enter -0-) ................................................................2

Total taxable amount: (Add Lines 1 and 2. If total is $70,000 or more, skip Lines 4 through 7 and enter amount on Line 8) .....3

3.

4.

Multiply Line 3 by 50% (.50); but do not enter more than $10,000: ............................................4

5.

Subtract $20,000 from Line 3 and enter the difference

If result is zero or less, enter -0-: ..................................................... 5

6.

Multiply Line 5 by 20% (.20): ......................................................................................................6

7.

Minimum distribution allowance: (Subtract Line 6 from Line 4) ............................................................................................7

8.

Subtract Line 7 from Line 3:..................................................................................................................................................8

9.

Multiply Line 8 by 10% (.10): ................................................................................................................................................9

10.

Tax on the amount on Line 9: (Use tax rate schedule on reverse side)..............................................................................10

11.

Multiply Line 10 by ten (10). If Line 2 is zero, skip Lines 12 through 17, and enter on Line 18: ......................................... 11

12.

Divide Line 2 by Line 3: (Carry to four places to the right of the decimal) ..........................................................................12

13.

Multiply Line 7 by Line 12: ..................................................................................................................................................13

14.

Subtract Line 13 from Line 2:..............................................................................................................................................14

15.

Multiply Line 14 by 10% (.10): ............................................................................................................................................15

16.

Tax on amount on Line 15: (Use tax rate schedule on reverse side)..................................................................................16

17.

Multiply Line 16 by ten (10):................................................................................................................................................17

18.

Subtract Line 17 from Line 11: (Enter this amount on Line 29 of Form AR1000F/AR1000NR) ..........................................18

AR1000TD (R 2/3/14)

1

1 2

2