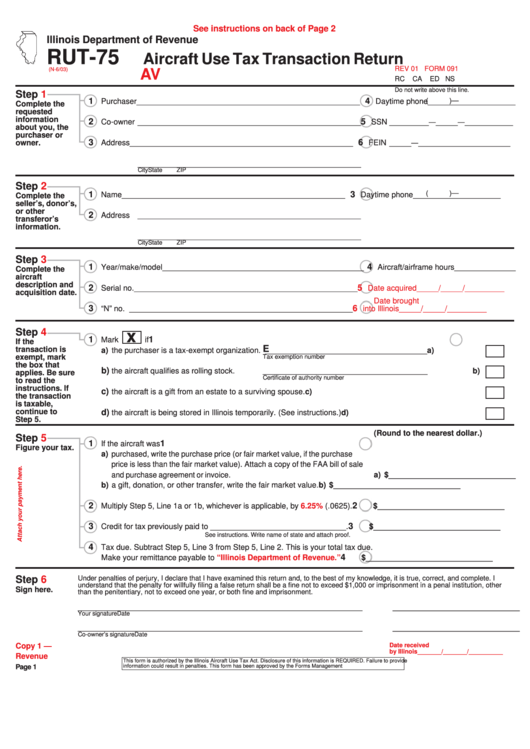

Form Rut-75 Aircraft Use Tax Transaction Return - Illinois Department Of Revenue

ADVERTISEMENT

See instructions on back of Page 2

Illinois Department of Revenue

RUT-75

Aircraft Use Tax Transaction Return

REV 01

FORM 091

(N-6/03)

AV

RC

CA

ED NS

Do not write above this line.

Step

1

1

4

(

)

—

Purchaser ___________________________________________________

Daytime phone ____________________

Complete the

requested

information

2

5

Co-owner ___________________________________________________

SSN _________

_____

___________

—

—

about you, the

purchaser or

3

6

owner.

Address ___________________________________________________

FEIN _____

_____________________

—

___________________________________________________

City

State

ZIP

Step

2

1

3

(

)

—

Name

___________________________________________________

Daytime phone ____________________

Complete the

seller’s, donor’s,

or other

2

Address ___________________________________________________

transferor’s

information.

___________________________________________________

City

State

ZIP

Step

3

1

4

Year/make/model______________________________________________

Aircraft/airframe hours ______________

Complete the

aircraft

description and

2

5

Serial no. ___________________________________________________

Date acquired _____/_____/_________

acquisition date.

Date brought

3

6

“N” no.

___________________________________________________

into Illinois

_____/_____/_________

Step

4

x

1

1

Mark

if

If the

E

transaction is

a) the purchaser is a tax-exempt organization. _____________________________________

a)

exempt, mark

Tax exemption number

the box that

b)

the aircraft qualifies as rolling stock.

______________________________________

b)

applies. Be sure

Certificate of authority number

to read the

instructions. If

c)

the aircraft is a gift from an estate to a surviving spouse.

c)

the transaction

is taxable,

continue to

d)

the aircraft is being stored in Illinois temporarily. (See instructions.)

d)

Step 5.

(Round to the nearest dollar.)

Step

5

1

1

If the aircraft was

Figure your tax.

a) purchased, write the purchase price (or fair market value, if the purchase

price is less than the fair market value). Attach a copy of the FAA bill of sale

and purchase agreement or invoice.

a) $_____________________________

b) a gift, donation, or other transfer, write the fair market value.

b) $_____________________________

2

2

Multiply Step 5, Line 1a or 1b, whichever is applicable, by

6.25%

(.0625).

$_____________________________

3

3

Credit for tax previously paid to _______________________________.

$_____________________________

See instructions. Write name of state and attach proof.

4

Tax due. Subtract Step 5, Line 3 from Step 5, Line 2. This is your total tax due.

4

Make your remittance payable to

“Illinois Department of Revenue.”

$_____________________________

Step

6

Under penalties of perjury, I declare that I have examined this return and, to the best of my knowledge, it is true, correct, and complete. I

understand that the penalty for willfully filing a false return shall be a fine not to exceed $1,000 or imprisonment in a penal institution, other

Sign here.

than the penitentiary, not to exceed one year, or both fine and imprisonment.

_________________________________________________________________

_____________________________

Your signature

Date

_________________________________________________________________

_____________________________

Co-owner’s signature

Date

Date received

Copy 1 —

by Illinois

_______/_______/__________

Revenue

This form is authorized by the Illinois Aircraft Use Tax Act. Disclosure of this information is REQUIRED. Failure to provide

information could result in penalties. This form has been approved by the Forms Management Center.

IL-492-4350

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3