Form Sw-100 - Solid Waste Management Fee Return - Indiana Department Of Revenue

ADVERTISEMENT

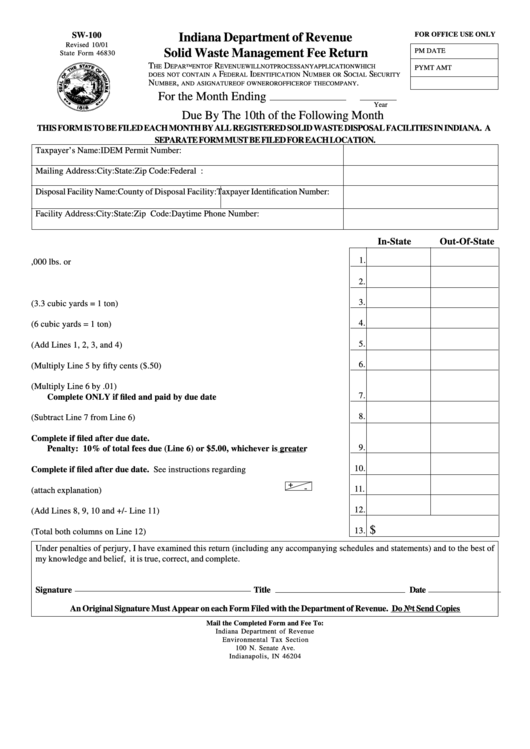

SW-100

FOR OFFICE USE ONLY

Indiana Department of Revenue

Revised 10/01

Solid Waste Management Fee Return

PM DATE

State Form 46830

T

D

R

HE

EPARTMENT OF

EVENUE WILL NOT PROCESS ANY APPLICATION WHICH

PYMT AMT

F

I

N

S

S

DOES NOT CONTAIN A

EDERAL

DENTIFICATION

UMBER OR

OCIAL

ECURITY

N

,

.

UMBER

AND A SIGNATURE OF OWNER OR OFFICER OF THE COMPANY

For the Month Ending

Year

Due By The 10th of the Following Month

THIS FORM IS TO BE FILED EACH MONTH BY ALL REGISTERED SOLID WASTE DISPOSAL FACILITIES IN INDIANA. A

SEPARATE FORM MUST BE FILED FOR EACH LOCATION.

Taxpayer’s Name:

IDEM Permit Number:

Mailing Address:

City:

State:

Zip Code:

Federal I.D. Number:

Disposal Facility Name:

County of Disposal Facility:

Taxpayer Identification Number:

Facility Address:

City:

State:

Zip Code:

Daytime Phone Number:

In-State

Out-Of-State

1.

1. Number of Solid Waste Deliveries by vehicles 9,000 lbs. or less...................................

2.

2. Total tons of solid waste weighed on a qualified scale...................................................

3.

3. Total tons of COMPACTED solid waste (3.3 cubic yards = 1 ton)...............................

4.

4. Total tons of UNCOMPACTED solid waste (6 cubic yards = 1 ton)..............................

5.

5. Total. (Add Lines 1, 2, 3, and 4)...................................................................................

6.

6. Total Fees Due. (Multiply Line 5 by fifty cents ($.50)..................................................

7. Collection Deduction. (Multiply Line 6 by .01)

7.

Complete ONLY if filed and paid by due date...........................................................

8.

8. Adjusted Fees Due. (Subtract Line 7 from Line 6)........................................................

9. Penalty. Complete if filed after due date.

9.

Penalty: 10% of total fees due (Line 6) or $5.00, whichever is greater..................

10.

10. Interest. Complete if filed after due date. See instructions regarding interest..........

+

-

11.

11. Adjustment - Indicate plus or minus (attach explanation).............................................

12.

12. Adjusted Fees Due. (Add Lines 8, 9, 10 and +/- Line 11)...........................................

$

13.

13. NET FEES DUE. (Total both columns on Line 12).....................................................

Under penalties of perjury, I have examined this return (including any accompanying schedules and statements) and to the best of

my knowledge and belief, it is true, correct, and complete.

Signature

Title

Date

An Original Signature Must Appear on each Form Filed with the Department of Revenue. Do Not Send Copies

Mail the Completed Form and Fee To:

Indiana Department of Revenue

Environmental Tax Section

100 N. Senate Ave.

Indianapolis, IN 46204

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1