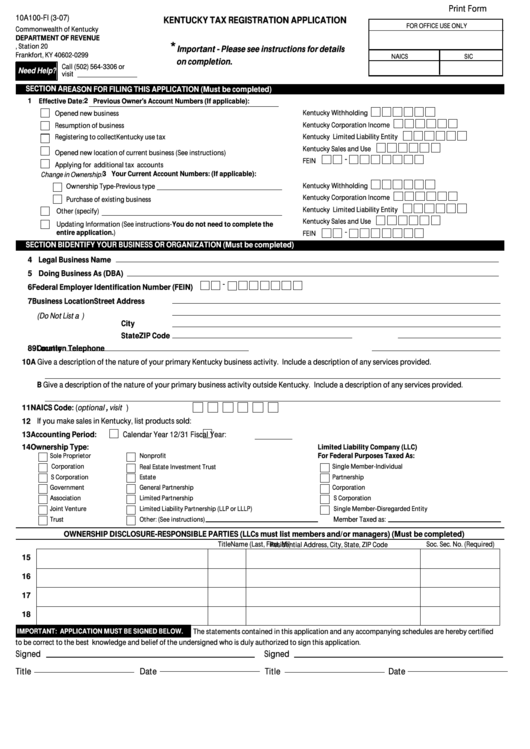

Form 10a100-Fi - 2007 - Kentucky Tax Registration Application - Kentucky Department Of Revenue

ADVERTISEMENT

Print Form

10A100-FI (3-07)

KENTUCKY TAX REGISTRATION APPLICATION

FOR OFFICE USE ONLY

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

*

P.O. Box 299, Station 20

Important - Please see instructions for details

Frankfort, KY 40602-0299

NAICS

SIC

on completion.

Call (502) 564-3306 or

Need Help?

visit

SECTION A

REASON FOR FILING THIS APPLICATION (Must be completed)

1 Effective Date:

2 Previous Owner's Account Numbers (If applicable):

Opened new business

Kentucky Withholding

Kentucky Corporation Income

Resumption of business

Kentucky Limited Liability Entity

Registering to collect Kentucky use tax

Kentucky Sales and Use

Opened new location of current business (See instructions)

-

FEIN

Applying for additional tax accounts

3 Your Current Account Numbers: (If applicable):

Change in Ownership:

Kentucky Withholding

Ownership Type-Previous type

Kentucky Corporation Income

Purchase of existing business

Kentucky Limited Liability Entity

Other (specify)

Kentucky Sales and Use

Updating Information (See instructions-You do not need to complete the

-

entire application.)

FEIN

SECTION B

IDENTIFY YOUR BUSINESS OR ORGANIZATION (Must be completed)

4

Legal Business Name

5

Doing Business As (DBA)

-

6 Federal Employer Identification Number (FEIN)

7 Business Location

Street Address

(Do Not List a P.O.Box)

City

State

ZIP Code

8

County

9 Location Telephone

10 A Give a description of the nature of your primary Kentucky business activity. Include a description of any services provided.

B Give a description of the nature of your primary business activity outside Kentucky. Include a description of any services provided.

11 NAICS Code: (optional , visit )

12 If you make sales in Kentucky, list products sold:

13 Accounting Period:

Calendar Year 12/31

Fiscal Year:

14 Ownership Type:

Limited Liability Company (LLC)

For Federal Purposes Taxed As:

Sole Proprietor

Nonprofit

Corporation

Single Member-Individual

Real Estate Investment Trust

S Corporation

Estate

Partnership

Government

General Partnership

Corporation

Association

Limited Partnership

S Corporation

Joint Venture

Limited Liability Partnership (LLP or LLLP)

Single Member-Disregarded Entity

Trust

Other: (See instructions)

Member Taxed as:

OWNERSHIP DISCLOSURE-RESPONSIBLE PARTIES (LLCs must list members and/or managers) (Must be completed)

Name (Last, First, MI)

Title

Soc. Sec. No. (Required)

Residential Address, City, State, ZIP Code

15

16

17

18

IMPORTANT: APPLICATION MUST BE SIGNED BELOW.

The statements contained in this application and any accompanying schedules are hereby certified

to be correct to the best knowledge and belief of the undersigned who is duly authorized to sign this application.

Signed

Signed

Title

Date

Title

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4