Nebraska Schedules I, Ii, And Iii Instructions

ADVERTISEMENT

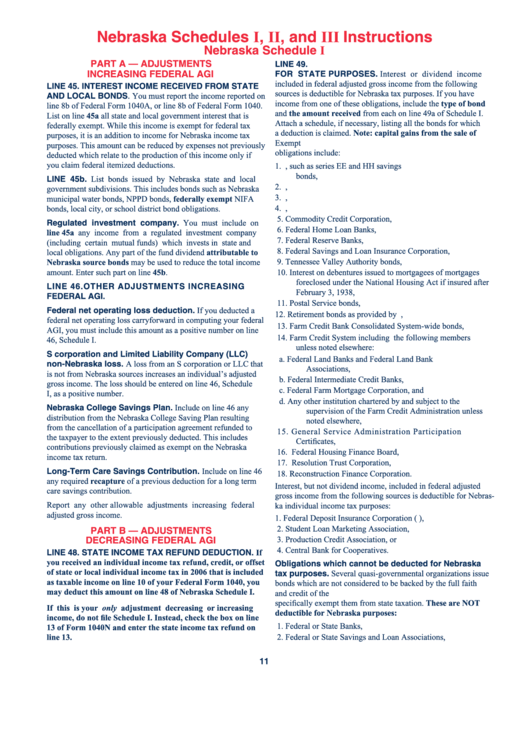

Nebraska Schedules I, II, and III Instructions

Nebraska Schedule I

PART A — ADJUSTMENTS

LINE 49. U.S. GOVERNMENT OBLIGATIONS EXEMPT

INCREASING FEDERAL AGI

FOR STATE PURPOSES. Interest or dividend income

included in federal adjusted gross income from the following

LINE 45. INTEREST INCOME RECEIVED FROM STATE

sources is deductible for Nebraska tax purposes. If you have

AND LOCAL BONDS. You must report the income reported on

income from one of these obligations, include the type of bond

line 8b of Federal Form 1040A, or line 8b of Federal Form 1040.

and the amount received from each on line 49a of Schedule I.

List on line 45a all state and local government interest that is

Attach a schedule, if necessary, listing all the bonds for which

federally exempt. While this income is exempt for federal tax

a deduction is claimed. Note: capital gains from the sale of

purposes, it is an addition to income for Nebraska income tax

U.S. obligations are not deductible. Exempt U.S. government

purposes. This amount can be reduced by expenses not previously

obligations include:

deducted which relate to the production of this income only if

you claim federal itemized deductions.

1. U.S. government bonds, such as series EE and HH savings

bonds,

LINE 45b. List bonds issued by Nebraska state and local

2. U.S. Treasury bills,

government subdivisions. This includes bonds such as Nebraska

3. U.S. government notes,

municipal water bonds, NPPD bonds, federally exempt NIFA

4. U.S. government certificates,

bonds, local city, or school district bond obligations.

5. Commodity Credit Corporation,

Regulated investment company. You must include on

6. Federal Home Loan Banks,

line 45a any income from a regulated investment company

7. Federal Reserve Banks,

(including certain mutual funds) which invests in state and

8. Federal Savings and Loan Insurance Corporation,

local obligations. Any part of the fund dividend attributable to

9. Tennessee Valley Authority bonds,

Nebraska source bonds may be used to reduce the total income

amount. Enter such part on line 45b.

10. Interest on debentures issued to mortgagees of mortgages

foreclosed under the National Housing Act if insured after

LINE 46. OTHER ADJUSTMENTS INCREASING

February 3, 1938,

FEDERAL AGI.

11. Postal Service bonds,

Federal net operating loss deduction. If you deducted a

12. Retirement bonds as provided by I.R.C. section 409,

federal net operating loss carryforward in computing your federal

13. Farm Credit Bank Consolidated System-wide bonds,

AGI, you must include this amount as a positive number on line

14. Farm Credit System including the following members

46, Schedule I.

unless noted elsewhere:

S corporation and Limited Liability Company (LLC)

a. Federal Land Banks and Federal Land Bank

non-Nebraska loss. A loss from an S corporation or LLC that

Associations,

is not from Nebraska sources increases an individual’s adjusted

b. Federal Intermediate Credit Banks,

gross income. The loss should be entered on line 46, Schedule

c. Federal Farm Mortgage Corporation, and

I, as a positive number.

d. Any other institution chartered by and subject to the

Nebraska College Savings Plan. Include on line 46 any

supervision of the Farm Credit Administration unless

distribution from the Nebraska College Saving Plan resulting

noted elsewhere,

from the cancellation of a participation agreement refunded to

15. General

Service

Administration

Participation

the taxpayer to the extent previously deducted. This includes

Certificates,

contributions previously claimed as exempt on the Nebraska

16. Federal Housing Finance Board,

income tax return.

17. Resolution Trust Corporation,

Long-Term Care Savings Contribution. Include on line 46

18. Reconstruction Finance Corporation.

any required recapture of a previous deduction for a long term

Interest, but not dividend income, included in federal adjusted

care savings contribution.

gross income from the following sources is deductible for Nebras-

Report any other allowable adjustments increasing federal

ka individual income tax purposes:

adjusted gross income.

1. Federal Deposit Insurance Corporation (F.D.I.C.),

2. Student Loan Marketing Association,

PART B — ADJUSTMENTS

DECREASING FEDERAL AGI

3. Production Credit Association, or

4. Central Bank for Cooperatives.

LINE 48. STATE INCOME TAX REFUND DEDUCTION. If

you received an individual income tax refund, credit, or offset

Obligations which cannot be deducted for Nebraska

of state or local individual income tax in 2006 that is included

tax purposes. Several quasi-governmental organizations issue

as taxable income on line 10 of your Federal Form 1040, you

bonds which are not considered to be backed by the full faith

may deduct this amount on line 48 of Nebraska Schedule I.

and credit of the U.S. government or whose licensing act did not

specifically exempt them from state taxation. These are NOT

If this is your only adjustment decreasing or increasing

deductible for Nebraska purposes:

income, do not file Schedule I. Instead, check the box on line

1. Federal or State Banks,

13 of Form 1040N and enter the state income tax refund on

2. Federal or State Savings and Loan Associations,

line 13.

11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5