Form St-30 - Multiple Points Of Use (Mpu) Sourcing Certificate - Kansas

ADVERTISEMENT

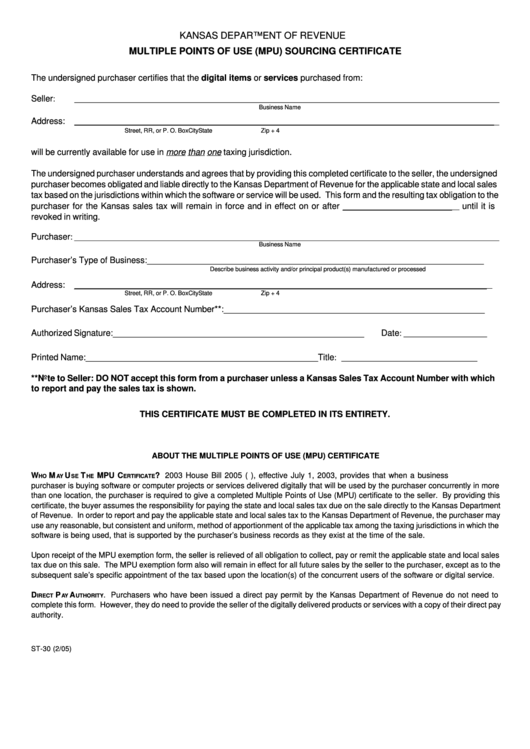

KANSAS DEPARTMENT OF REVENUE

MULTIPLE POINTS OF USE (MPU) SOURCING CERTIFICATE

The undersigned purchaser certifies that the digital items or services purchased from:

Seller

:

_________________________________________________________________________________________________

Business Name

Address:

_________________________________________________________________________________________________

Street, RR, or P. O. Box

City

State

Zip + 4

will be currently available for use in more than one taxing jurisdiction.

The undersigned purchaser understands and agrees that by providing this completed certificate to the seller, the undersigned

purchaser becomes obligated and liable directly to the Kansas Department of Revenue for the applicable state and local sales

tax based on the jurisdictions within which the software or service will be used. This form and the resulting tax obligation to the

purchaser for the Kansas sales tax will remain in force and in effect on or after _______________________

until it is

revoked in writing.

Purchaser

: _________________________________________________________________________________________________

Business Name

Purchaser’s Type of Business: _______________________________________________________________________

Describe business activity and/or principal product(s) manufactured or processed

Address:

_______________________________________________________________________________________

Street, RR, or P. O. Box

City

State

Zip + 4

Purchaser’s Kansas Sales Tax Account Number**: _______________________________________________________

Authorized Signature: _____________________________________________________

Date

: ___________________

Printed Name: _________________________________________________

Title

: _______________________________

**Note to Seller: DO NOT accept this form from a purchaser unless a Kansas Sales Tax Account Number with which

to report and pay the sales tax is shown.

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

ABOUT THE MULTIPLE POINTS OF USE (MPU) CERTIFICATE

W

M

U

T

MPU C

? 2003 House Bill 2005 (K.S.A. 79-3671), effective July 1, 2003, provides that when a business

HO

AY

SE

HE

ERTIFICATE

purchaser is buying software or computer projects or services delivered digitally that will be used by the purchaser concurrently in more

than one location, the purchaser is required to give a completed Multiple Points of Use (MPU) certificate to the seller. By providing this

certificate, the buyer assumes the responsibility for paying the state and local sales tax due on the sale directly to the Kansas Department

of Revenue. In order to report and pay the applicable state and local sales tax to the Kansas Department of Revenue, the purchaser may

use any reasonable, but consistent and uniform, method of apportionment of the applicable tax among the taxing jurisdictions in which the

software is being used, that is supported by the purchaser’s business records as they exist at the time of the sale.

Upon receipt of the MPU exemption form, the seller is relieved of all obligation to collect, pay or remit the applicable state and local sales

tax due on this sale. The MPU exemption form also will remain in effect for all future sales by the seller to the purchaser, except as to the

subsequent sale’s specific appointment of the tax based upon the location(s) of the concurrent users of the software or digital service.

D

P

A

. Purchasers who have been issued a direct pay permit by the Kansas Department of Revenue do not need to

IRECT

AY

UTHORITY

complete this form. However, they do need to provide the seller of the digitally delivered products or services with a copy of their direct pay

authority.

ST-30 (2/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1