Wv/tp702-Cp - Cigarette Purchaser Excise And Use Tax Report Form

ADVERTISEMENT

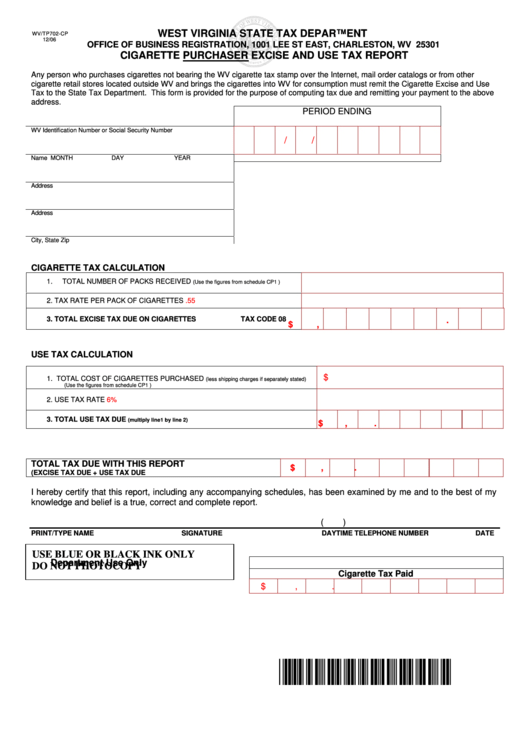

WEST VIRGINIA STATE TAX DEPARTMENT

WV/TP702-CP

12/06

OFFICE OF BUSINESS REGISTRATION, 1001 LEE ST EAST, CHARLESTON, WV 25301

CIGARETTE PURCHASER EXCISE AND USE TAX REPORT

Any person who purchases cigarettes not bearing the WV cigarette tax stamp over the Internet, mail order catalogs or from other

cigarette retail stores located outside WV and brings the cigarettes into WV for consumption must remit the Cigarette Excise and Use

Tax to the State Tax Department. This form is provided for the purpose of computing tax due and remitting your payment to the above

address.

PERIOD ENDING

WV Identification Number or Social Security Number

/

/

Name

MONTH

DAY

YEAR

Address

Address

City, State Zip

CIGARETTE TAX CALCULATION

1.

TOTAL NUMBER OF PACKS RECEIVED

(Use the figures from schedule CP1 )

2.

TAX RATE PER PACK OF CIGARETTES

.55

3.

TOTAL EXCISE TAX DUE ON CIGARETTES

TAX CODE 08

$

,

.

USE TAX CALCULATION

$

1.

TOTAL COST OF CIGARETTES PURCHASED

(less shipping charges if separately stated)

(Use the figures from schedule CP1 )

2.

USE TAX RATE

6%

3.

TOTAL USE TAX DUE

(multiply line1 by line 2)

$

,

.

TOTAL TAX DUE WITH THIS REPORT

$

,

.

(EXCISE TAX DUE + USE TAX DUE

I hereby certify that this report, including any accompanying schedules, has been examined by me and to the best of my

knowledge and belief is a true, correct and complete report.

(

)

PRINT/TYPE NAME

SIGNATURE

DAYTIME TELEPHONE NUMBER

DATE

USE BLUE OR BLACK INK ONLY

Department Use Only

DO NOT PHOTOCOPY

Cigarette Tax Paid

$

,

.

*O50110601W*

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3