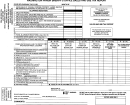

Wv/tp702-Cp - Cigarette Purchaser Excise And Use Tax Report Form Page 3

ADVERTISEMENT

INSTRUCTIONS FOR COMPLETING

CIGARETTE PURCHASER EXCISE AND USE TAX REPORT

Please print or type all information on this report.

WV Identification Number or Social Security Number:

Enter your Social Security Number or WV Identification Number, Name, Address, City, State, and Zip Code.

Period Covered by Report:

th

Enter the month and year the cigarettes were purchased. This report is due the 15

of each month following receipt of

products.

Cigarette Excise Tax Calculation:

Line 1 - Add the total number of packs purchased as entered on Schedule 1.

Line 2 – Tax rate.

Line 3 – Multiply the total number of packs purchased on line 1 by the tax rate on line 2. This is the amount of cigarette

tax you owe.

Use Tax Calculation:

Line 1 – Enter the total cost of cigarettes purchased (less any shipping charges if separately stated).

Line 2 – Tax rate.

Line 3 – Multiply line 1 by the tax rate on line 2. This is the amount of use tax you owe

SCHEDULE 1

Purchase Information:

Enter the brand names of the cigarettes and/or other tobacco products purchased. Do not list subcategories such as

regular, menthol, 100’s, etc.

Enter the name, address, website and phone number (if available) of the business/person(s) from whom each pack of

cigarettes were purchased.

Enter the date(s) the cigarettes were purchased.

Enter the number of packs of cigarettes purchased.

Enter the cost of cigarettes purchased.

Please remit payment for both taxes. Make check payable to WV State Tax Department and mail to:

WV State Tax Department

Office of Business Registration

1001 Lee St East

Charleston, WV 25301

Please sign and date both reports. Include a telephone number where you can be reached should we have any questions

regarding your report.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3