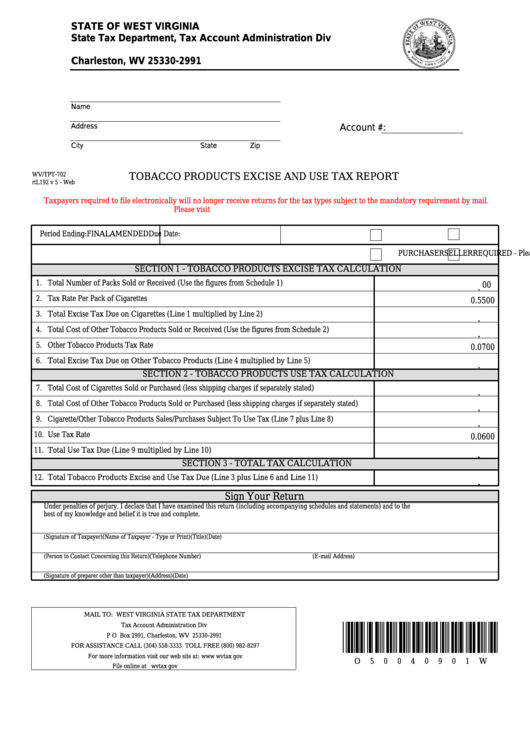

STATE OF WEST VIRGINIA

State Tax Department, Tax Account Administration Div

P.O. Box 2991

Charleston, WV 25330-2991

Name

Address

Account #:

City

State

Zip

WV/TPT-702

TOBACCO PRODUCTS EXCISE AND USE TAX REPORT

rtL192 v 5 - Web

Taxpayers required to file electronically will no longer receive returns for the tax types subject to the mandatory requirement by mail.

Please visit for additional information.

Period Ending:

Due Date:

FINAL

AMENDED

REQUIRED - Please select the type of return being filed:

SELLER

PURCHASER

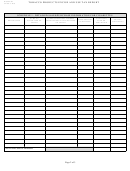

SECTION 1 - TOBACCO PRODUCTS EXCISE TAX CALCULATION

1.

Total Number of Packs Sold or Received (Use the figures from Schedule 1)

.

00

2.

Tax Rate Per Pack of Cigarettes

0.5500

3.

Total Excise Tax Due on Cigarettes (Line 1 multiplied by Line 2)

.

4.

Total Cost of Other Tobacco Products Sold or Received (Use the figures from Schedule 2)

.

5.

Other Tobacco Products Tax Rate

0.0700

6.

Total Excise Tax Due on Other Tobacco Products (Line 4 multiplied by Line 5)

.

SECTION 2 - TOBACCO PRODUCTS USE TAX CALCULATION

7.

Total Cost of Cigarettes Sold or Purchased (less shipping charges if separately stated)

.

8.

Total Cost of Other Tobacco Products Sold or Purchased (less shipping charges if separately stated)

.

9.

Cigarette/Other Tobacco Products Sales/Purchases Subject To Use Tax (Line 7 plus Line 8)

.

10.

Use Tax Rate

0.0600

11.

Total Use Tax Due (Line 9 multiplied by Line 10)

.

SECTION 3 - TOTAL TAX CALCULATION

12.

Total Tobacco Products Excise and Use Tax Due (Line 3 plus Line 6 and Line 11)

.

Sign Your Return

Under penalties of perjury, I declare that I have examined this return (including accompanying schedules and statements) and to the

best of my knowledge and belief it is true and complete.

(Signature of Taxpayer)

(Name of Taxpayer - Type or Print)

(Title)

(Date)

(Person to Contact Concerning this Return)

(Telephone Number)

(E-mail Address)

(Signature of preparer other than taxpayer)

(Address)

(Date)

MAIL TO: WEST VIRGINIA STATE TAX DEPARTMENT

Tax Account Administration Div

P O Box 2991, Charleston, WV 25330-2991

FOR ASSISTANCE CALL (304) 558-3333 TOLL FREE (800) 982-8297

For more information visit our web site at: www wvtax gov

O

5

0

0

4

0

9

0

1

W

File online at https://mytaxes wvtax gov

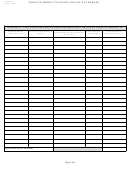

1

1 2

2 3

3