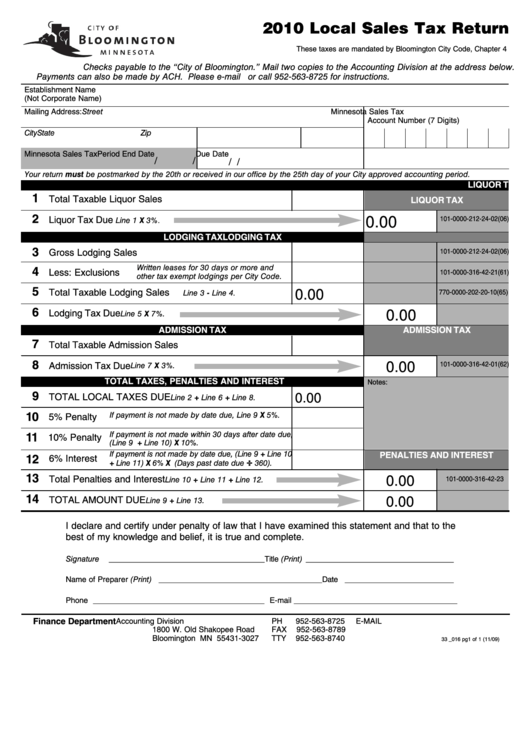

2010 Local Sales Tax Return

These taxes are mandated by Bloomington City Code, Chapter 4

Checks payable to the “City of Bloomington. ” Mail two copies to the Accounting Division at the address below.

Payments can also be made by ACH. Please e-mail kcarlson@ci.bloomington.mn.us or call 952-563-8725 for instructions.

Establishment Name

(Not Corporate Name)

Mailing Address:

Street

Minnesota Sales Tax

Account Number (7 Digits)

City

State

Zip

Minnesota Sales Tax

Period End Date

Due Date

/

/

/

/

Your return must be postmarked by the 20th or received in our office by the 25th day of your City approved accounting period.

LIQUOR TAX

Office Use Only

1

LIQUOR TAX

Total Taxable Liquor Sales

2

Line 1 X 3%.

0.00

Liquor Tax Due

101-0000-212-24-02(06)

LODGING TAX

LODGING TAX

3

Gross Lodging Sales

101-0000-212-24-02(06)

4

Written leases for 30 days or more and

Less: Exclusions

101-0000-316-42-21(61)

other tax exempt lodgings per City Code.

5

Line 3 - Line 4.

0.00

Total Taxable Lodging Sales

770-0000-202-20-10(65)

6

Line 5 X 7%.

0.00

Lodging Tax Due

ADMISSION TAX

ADMISSION TAX

7

Total Taxable Admission Sales

8

Line 7 X 3%.

0.00

101-0000-316-42-01(62)

Admission Tax Due

TOTAL TAXES, PENALTIES AND INTEREST

Notes:

9

Line 2 + Line 6 + Line 8.

0.00

TOTAL LOCAL TAXES DUE

10

If payment is not made by date due, Line 9 X 5%.

5% Penalty

11

If payment is not made within 30 days after date due,

10% Penalty

(Line 9 + Line 10) X 10%.

If payment is not made by date due, (Line 9 + Line 10

PENALTIES AND INTEREST

12

6% Interest

÷

+ Line 11) X 6% X (Days past date due

360).

13

Line 10 + Line 11 + Line 12.

Total Penalties and Interest

0.00

101-0000-316-42-23

14

Line 9 + Line 13.

0.00

TOTAL AMOUNT DUE

I declare and certify under penalty of law that I have examined this statement and that to the

best of my knowledge and belief, it is true and complete.

Signature

________________________________________ Title (Print) ______________________________________

Name of Preparer (Print) __________________________________________ Date ____________________________

Phone ____________________________________________ E-mail __________________________________________

Finance Department

Accounting Division

PH

952-563-8725

E-MAIL kcarlson@ci.bloomington.mn.us

1800 W. Old Shakopee Road

FAX

952-563-8789

Bloomington MN 55431-3027

TTY

952-563-8740

33 _016 pg1 of 1 (11/09)

Clear Form

Submit Form

1

1