Business License Application Fee Worksheet - Kirkland Page 3

ADVERTISEMENT

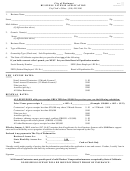

Business License Application Fee Worksheet

Registration

You may be eligible to pay a registration fee of $50 in lieu of a business license fee under the following circumstances.

1. Are the annual gross receipts of your business less than $12,000?

Yes

No

$________________

If yes, stop here. Your registration fee is $50.

Exemptions:

You may be eligible to register a business license application under this chapter and be exempt from any fees.

1. Are you a qualified governmental or religious organization?

Yes

No

If you engage exclusively in religious activities or governmental functions, or if any of your activities go beyond core religious

functions, or if any of your activities go beyond core governmental functions, then skip down to the regular business license

section. You will pay a base fee and follow special instructions for calculating the Revenue Generating Regulatory License.

2. Are you a civic group, service club, or social organization?

Yes

No

that are not engaged in any profession, trade, calling, or occupation, but are organized to provide civic, service, or social

activities in the city.

3. Are you a non-profit organization exempt from Federal Income Tax?

Yes

No

(a copy of the 501(c)(30 is required)

If you answered yes to questions 1 - 3, stop here. Your registration fee is $0. Registration of business and and annual updated

information required. All other businesses proceed to next section.

If you do not qualify for an exemption or registration fee, the base fee and RGRL will apply as calculated below.

Base Fee: All businesses operating in Kirkland exceeding $12,000.00 are subject to a base fee of $100.

Revenue Generating Regulatory License Fee Calculation

How many employees (or Full Time Equivalents), including officer /

owner / manager, are employed at this location? If using part-time

Number of FTEs______ x $100 = $_______

employees, use the FTE calculation worksheet as shown on page 2.

Plus: BaseFee = $_______

Revenue Generating Regulatory License Fee: FTE x $100.00

Total Fee = $_______

Add the RGRL amount and the base fee. This total amount is your

business license tax fee.

Minimum payment $200.00. Must claim 1 employee.

Definitions:

Qualified Nonprofit Organization - Certain organizations exempt from Federal Income Tax. An organization that files with the

City a copy of its current IRS 501(c)(3) exemption certificate issued by the Internal Revenue Service.

Government Organization - A governmental entity that engages solely in the exercise of governmental functions. Activities

which are not exclusively governmental, such as some of the activities of a hospital or medical clinic, are not exempt under this

chapter.

Religious Organization - A nonprofit business operated exclusively for a religious purpose, upon furnishing proof of the Fi-

nance Director of its nonprofit status. For the purposes of this chapter, the activities that are not part of the core religious func-

tions are not exempt.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4