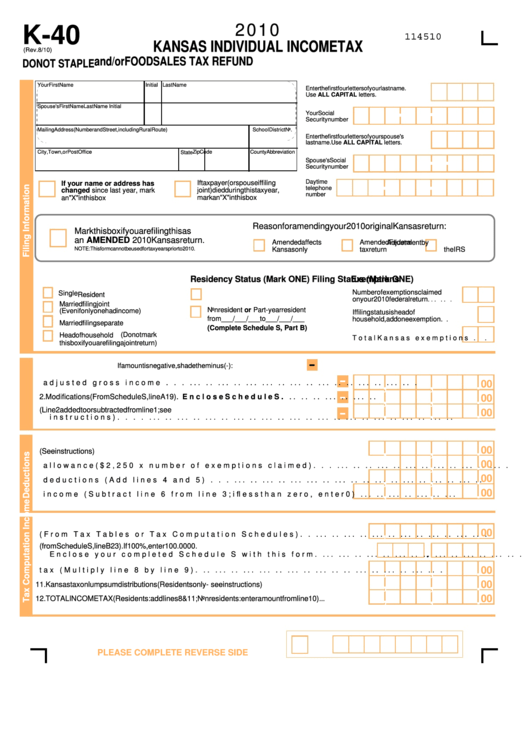

Form K-40 - Kansas Individual Income Tax And/or Food Sales Tax Refund - 2010

ADVERTISEMENT

2010

K-40

114510

KANSAS INDIVIDUAL INCOME TAX

(Rev. 8/10)

and/or FOOD SALES TAX REFUND

DO NOT STAPLE

Your First Name

Initial

Last Name

Enter the first four letters of your last name.

Use ALL CAPITAL letters.

- -

Spouse's First Name

Initial

Last Name

Your Social

Security number

Mailing Address (Number and Street, including Rural Route)

School District No.

Enter the first four letters of your spouse's

last name. Use ALL CAPITAL letters.

-

-

City, Town, or Post Office

Zip Code

County Abbreviation

State

Spouse's Social

Security number

-

Daytime

If your name or address has

If taxpayer (or spouse if filing

telephone

changed since last year, mark

joint) died during this tax year,

number

an "X" in this box

mark an "X" in this box

Reason for amending your 2010 original Kansas return:

Mark this box if you are filing this as

an AMENDED 2010 Kansas return.

Amended affects

Amended Federal

Adjustment by

NOTE: This form cannot be used for tax years prior to 2010.

Kansas only

tax return

the IRS

Filing Status (Mark ONE)

Residency Status (Mark ONE)

Exemptions

Number of exemptions claimed

Single

Resident

on your 2010 federal return

. . . . . .

Married filing joint

Nonresident or Part-year resident

(Even if only one had income)

If filing status is head of

from ___/___/___ to ___/___/___

household, add one exemption . . . . . . .

Married filing separate

(Complete Schedule S, Part B)

(Do not mark

Head of household

Total Kansas exemptions . . . . . . .

this box if you are filing a joint return)

-

If amount is negative, shade the minus (-) in box. Example:

-

,

,

.

1. Federal adjusted gross income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

-

,

,

.

2. Modifications (From Schedule S, line A19). Enclose Schedule S. . . . . . . . . . . . . . . . .

00

,

,

.

-

3. Kansas adjusted gross income (Line 2 added to or subtracted from line 1; see

00

instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

,

.

00

4. Standard deduction OR itemized deductions (See instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

.

00

5. Exemption allowance ($2,250 x number of exemptions claimed). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

,

.

00

6. Total deductions (Add lines 4 and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

,

.

00

7. Taxable income (Subtract line 6 from line 3; if less than zero, enter 0) . . . . . . . . . . . . . . . . . .

,

,

.

00

8. Tax (From Tax Tables or Tax Computation Schedules). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Nonresident allocation percentage (from Schedule S, line B23). If 100%, enter 100.0000.

.

Enclose your completed Schedule S with this form. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

,

.

00

10. Nonresident tax (Multiply line 8 by line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

,

,

.

00

11. Kansas tax on lump sum distributions (Residents only - see instructions) . . . . . . . . . . . . . . . . . . .

,

,

.

00

12. TOTAL INCOME TAX (Residents: add lines 8 & 11; Nonresidents: enter amount from line 10). . .

PLEASE COMPLETE REVERSE SIDE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2